A shortened trading day in the US on Monday may weigh heavily on trading activity but we will get some data early in the session, while there’s been no shortage of drivers elsewhere earlier in the day.

US Manufacturing Data Gives Mixed Picture For the Sector

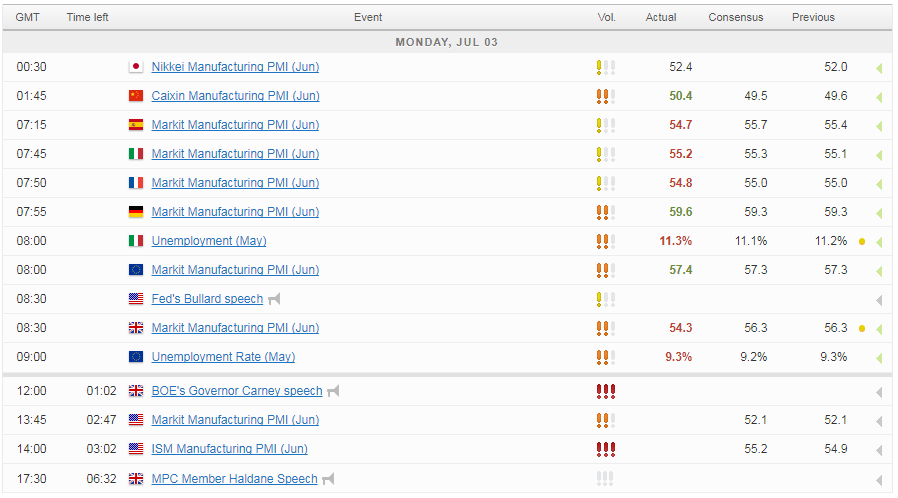

US markets will close early today ahead of tomorrow’s Independence Day bank holiday but prior to this we will get manufacturing PMIs for June. The Markit and ISM readings are expected to point to slightly differing pictures of the sector, with the former indicating slowing growth since the start of the year and the latter having come slightly off its highs but still showing strong growth.

EUR/USD – German and Eurozone Mfg. PMIs Meet Expectations, but Euro Dips

Attention over the next couple of days will likely remain on the UK and eurozone, given the bank holiday in the US, especially following the hawkish shift within the central banks. Both currencies made significant gains over the last week but are paring those moves this morning, with the manufacturing PMI data failing to provide the catalyst for another leg higher.

Eurozone Manufacturing Activity at Six Year High Driven By Germany

The eurozone PMI may have ticked slightly higher to a six year high, fuelling optimism about the recovery in the region, but this appeared to primarily reflect a very strong performance in Germany, with France, Spain and Italy all falling a little short of expectations. Still, the data is very good all round and suggests the outlook is improving all the time, to the delight of the ECB which is keen to move away from the ultra-accommodative policy it is currently adopting.

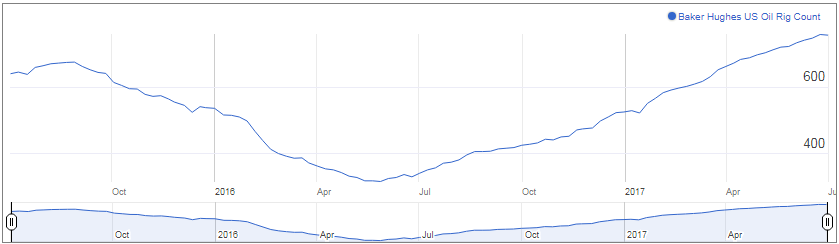

Oil Pares Losses Despite Small Drop in US Oil Rigs

The recent rally in oil is helping to drive gains in equity markets today, although we are seeing small losses in Brent and WTI following an impressive seven session winning run. The drop in oil rigs reported by Baker Hughes on Friday – only the second this year – appeared to be supporting oil earlier in the session but this soon petered out as profit taking set in. With losses currently only small in oil, there may be more upside to come in days ahead, despite sentiment having previously been extremely bearish.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.