Central bankers will be the centre of attention over the next couple of days, with a number of policy makers appearing, including Federal Reserve Chair Janet Yellen, ECB President Mario Draghi and the Bank of England Governor Mark Carney.

Yellen, Harker and Kashkari Scheduled to Appear

Already today, we’ve heard from Carney and Draghi – both of whom will appear again tomorrow – while Yellen is scheduled to appear later in the session, as well as fellow Fed policy makers Patrick Harker and Neel Kashkari – both of whom are voting members on the FOMC this year. Needless to say, this could prompt plenty of volatility throughout the session, as we’ve already seen in the euro and sterling.

EUR/USD – Euro Improves as Draghi Upbeat About Economy

EUR Climbs as Draghi Appears Open to Gradual Removal of Stimulus

The euro is climbing again on Tuesday, buoyed by comments from ECB President Mario Draghi who highlighted the strengthening and broadening recovery in the region. While Draghi is among the more dovish policy makers at the central bank, there has been persistent speculation that the ECB will announce further reductions in asset purchases later this year and a more positive assessment of the economy from the President may suggest he’s willing to back it.

Draghi maintained his dovish stance though, warning that the central bank needs to be prudent in how it adjusts its parameters to improving economic conditions, calling for any adjustments to be gradual and only when improving dynamics that justify them appear significantly secure. This suggests to me that he will back a gradual tightening in monetary policy, which we have been seeing an increasing demand for.

OANDA fxTrade Advanced Charting Platform

GBP Briefly Pops as FPC Raises Counter-Cyclical Capital Buffer

The pound – which was already trading higher against the dollar on the day, albeit largely down to weakness in the latter – briefly popped higher after the release of the Financial Stability Report, in which the Bank of England raised the counter-cyclical capital buffer to 0.5%, from 0%, and laid out plans to raise it to 1% in November. While banks have one year to implement the change, it still represents a minor tightening in financial conditions which triggered the initial move in sterling, a move that was almost immediately fully reversed.

It will be interesting to see how sterling trades in the coming hours and whether markets perceive this to be an effective tightening or an alternative to a rate hike that some policy makers have been leaning towards in recent months. Should the latter be true then I would expect to see the pound coming under a little pressure. It is currently trading below the levels it was at prior to the release but the moves are so small that we can’t read too much into them.

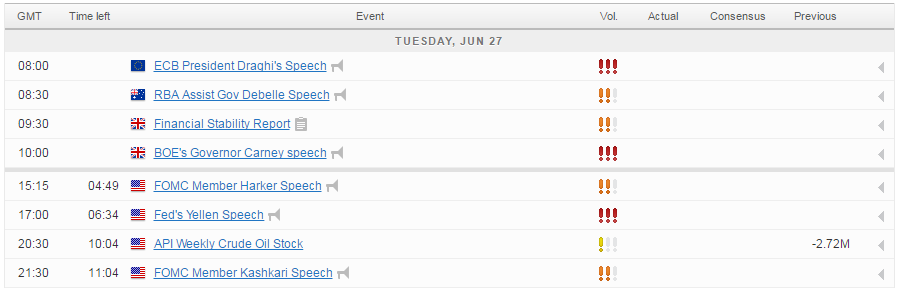

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.