It’s been a slow start to trading on Friday, with the lack of major news flow or notable releases meaning traders are left to digest the events of the last couple of days.

Equity Markets Higher But Quadruple Witching Likely Playing a Role

It’s difficult to read too much into moves in equity markets with today being the expiry of June futures and options – otherwise known as quadruple witching – likely playing a big role. It’s been a quiet morning so far in Europe, with the only notable data being the final inflation figures from the eurozone – both of which were unchanged, as expected – which is unlikely to have had much of an impact.

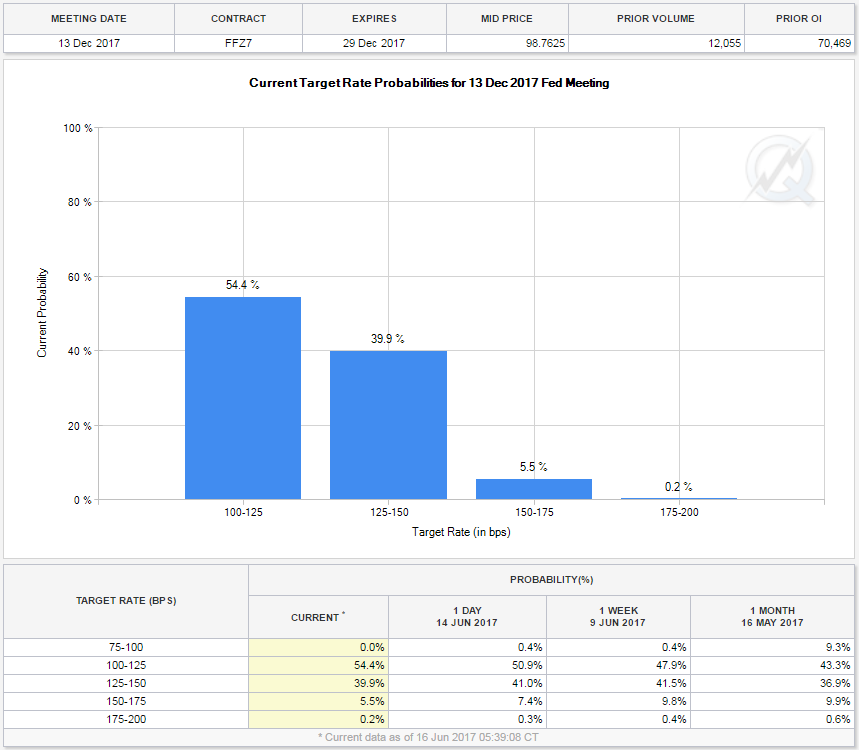

We do have more data to come from the US around the open on Wall Street, with building permits, housing starts, UoM consumer sentiment and inflation expectations figures all being released. The Fed raised interest rates earlier this week and signalled one more this year but traders still appear unconvinced, with another hike by December only around 45% priced in.

Source – CME Group FedWatch Tool

How the data performs between now and the end of the year should see the gap between the two close in the months ahead and today’s figures could offer some interesting insight, particularly the consumer and inflation numbers.

Oil Bounces Aahead of Baker Hughes Oil Rig Data

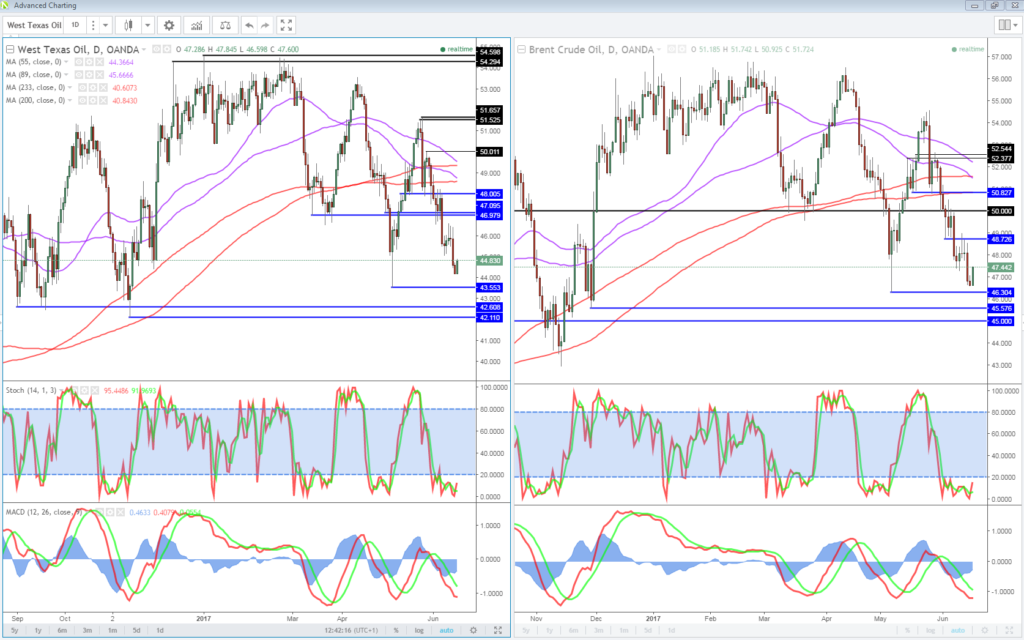

We’re seeing a small bounce in oil this morning as we await the Baker Hughes rig data later in the session. Brent and WTI crude have come under significant pressure since oil producers agreed to extend cuts by another nine months in a bid to rebalance the market and bring inventories back to their five year average. Whether US output will offset these cuts, or a significant portion of them, will be seen over the next year or so but as long as we keep seeing the rig count climb, prices could remain under pressure. Brent and WTI may have found some support around their May lows but should this level be breached, it could trigger another wave of selling and put pressure on producers to do more.

OANDA fxTrade Advanced Charting Platform

GBP Edges Higher But Political Uncertainty Continues to Weigh

Sterling is making minor gains this morning, buoyed by yesterday’s vote on interest rates at the Bank of England. Three policy makers surprisingly voted for a hike, with the outgoing Kristin Forbes the only one to have done so recently. While this doesn’t necessarily mean we’ll see a rate hike any time soon, it clearly indicates that policy makers are more hawkish than markets anticipated. Still, the pound’s gains against the dollar were capped around 1.28, reflecting the fact that downside pressure remains on the currency as a result of all the political uncertainty which comes at the worst possible time for the country.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.