It’s been quite a memorable night in the UK where once again an election has come and gone and results have come as quite a surprise to both voters and the markets, alike.

Only a month ago, with Theresa May’s poll lead at around 20 points, it appeared that the election was going to be a landslide leading to questions about the future of Jeremy Corbyn as Labour leader. One month on and the reality is that the Conservative campaign is being labelled a shambles, it’s on course to lose its majority and Corbyn is being praised for a quite remarkable comeback.

U.K. Parliament is Hung, Drawn and Quartered

While Labour voters may be celebrating, the markets are not in such a bright mood. A hung parliament – as looks very likely now – could be devastating for the preparation of Brexit negotiations which is due to begin in little over a week. A hung parliament was the worst outcome for the markets and yet, under the circumstances the response has been fairly mild. While the reason for this will only become apparent in the coming hours or days, the prospect of a coalition with the DUP or SNP which would take them above the threshold may be what markets are banking on.

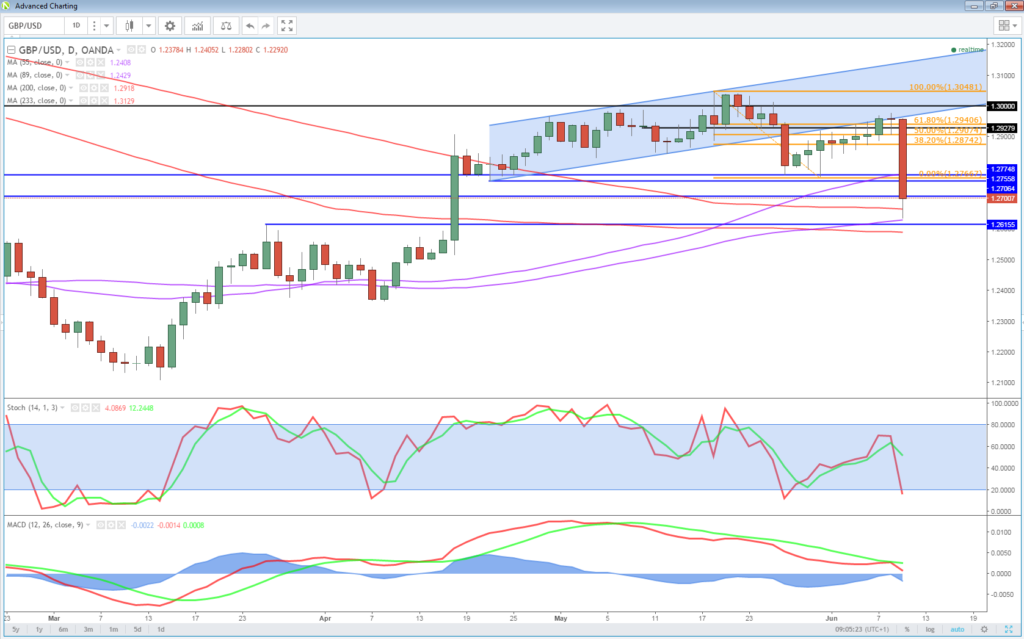

Should that fail to materialise, then the moves which we’ve already seen overnight in the pound may get much worse. The drop in GBPUSD after the exit polls was very significant but even then, it remains slightly above the level that it was trading at prior to May calling the election back in April. Clearly there is no panic yet but should coalition talks fail and the prospect of another election prevail, I struggle to see it maintaining these levels and it would seriously harm the UK’s position in Brexit talks and create huge uncertainty.

OANDA fxTrade Advanced Charting Platform

While the election may remain the focus as we see out the week, UK data will also attract some attention throughout the morning. Manufacturing and industrial production figures, along with trade balance data and an estimate of GDP for the three months to the end of May from NIESR will all be released.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.