European equity markets are expected to open a little lower on Tuesday, in-keeping with the moderate risk aversion that we’ve seen overnight and as traders look ahead to a number of major events on Thursday.

Gold and Yen Gain in Risk Averse Trade

It’s quite normal to see this kind of behaviour when the latter part of the week is as busy as it is. We’re seeing a little bit of risk aversion in the markets today with European futures tracking similarly small losses across the US and Asia, Gold making modest gains to trade at six week highs and the yen making further advances.

But we have a big week or so ahead of us with the UK heading to the polls and the ECB announcing its latest monetary policy decision on Thursday and the Federal Reserve doing the same next Wednesday. Once these events pass, we may have a little more clarity and therefore see a little less caution in the markets.

Conservative Lead Under Considerable Threat in Latest Survation Poll

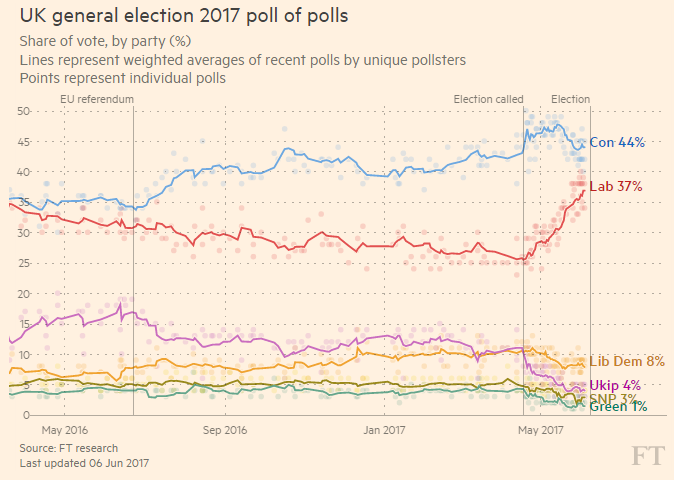

The UK election remains the standout event for most, with the outcome being so important for Brexit negotiations over the next couple of years. The Conservative lead over Labour has collapsed, if the polls are to be believed, and it seems that the only thing that Theresa May currently has on her side now is time, with Labour still having a lot to do and only two days in which to achieve it.

Source – FT Poll of Polls

As it is, a working majority is now in doubt with another poll released overnight from Survation showing the lead at only a single point.

USD/CAD Canadian Dollar Slightly Higher on Soft US Data

The pound has not been too shaken by the polls in recent days though, having shown a certain vulnerability to them prior to that. Despite the lead closing and May’s majority looking under threat, the pound has continued to grind higher against the dollar and remain just below 1.30, and has held its own against both the euro and the yen. Whether this reflects a lack of faith in the polls or just those that point to a much tighter race isn’t clear but there doesn’t appear to be much election risk being priced in which in itself concerns me given what’s happened previously.

OANDA fxTrade Advanced Charting Platform

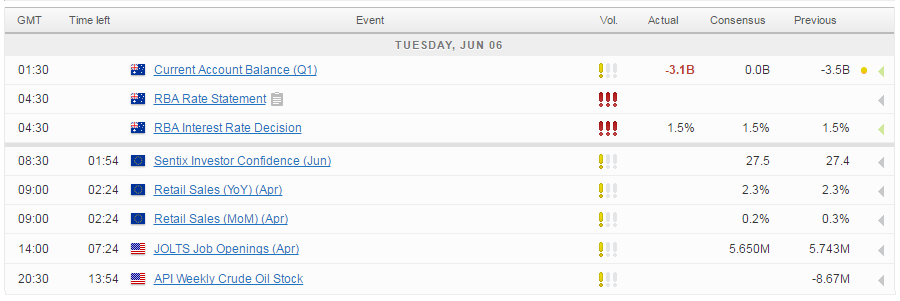

As far as today is concerned, it’s looking a little quiet on the releases front, with eurozone Sentix investor confidence and retail sales the only notable data this morning. We’ll also get JOLTS job openings from the US later this afternoon but aside from this, focus will likely remain on events later in the week.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.