Bank holiday’s across parts of Europe is contributing to relatively subdued trade at the start of the week, with a number of major events scheduled for the coming days also likely aiding this.

Is the Conservatives Majority at Risk?

Polls over the weekend continue to suggest that Theresa May’s lead is slipping, with another from YouGov suggesting that the Conservatives are set to lose their majority. Of course, different polls are still giving us a variety of outcomes, with some still pointing to a comfortable majority for the Conservatives, which appears to be the most market friendly scenario. The memory of 2015 when the Conservatives performed much better than expected may well be helping to support the pound, even as some surveys paint a worrying picture for Theresa May.

EUR/USD – Euro Dips Despite Solid German, Eurozone Services PMIs

While the UK election is likely to be a dominant theme for markets this week, there will also be a focus on the ECB meeting, which is also due to take place on Thursday. There has been a lot of speculation about how and when the central bank will withdraw its stimulus, with some suggesting they may hint at further reductions either this week or in September. The economy is undoubtedly on a positive trajectory but as the PMI reports showed this morning, it is still unbalanced with Germany being a significant driver of it.

Oil Remains Vulnerable Despite Early Boost

Oil has been boosted a little this morning by reports that Saudi Arabia, Egypt, UAE and Bahrain have severed diplomatic ties with Qatar, accusing the country of supporting terrorist organisations. Still, Brent and WTI crude continue to languish near last week’s lows, with traders appearing to doubt whether the coordinated measures undertaken by OPEC and non-OPEC members will be enough to address the oil glut. Brent had traded back above $50 again this morning but continues to look vulnerable having broken below here on Friday.

OANDA fxTrade Advanced Charting Platform

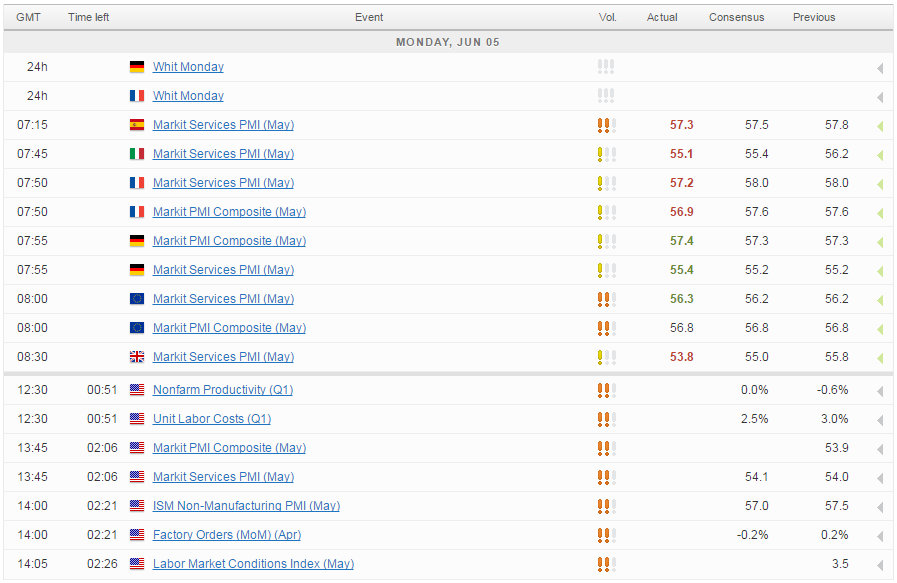

Still to come today we’ve got a number of economic reports from the US including services PMIs from Markit and ISM, as well as factory orders, unit labour costs and productivity figures. Last week’s jobs report hasn’t filled people with confidence in the US economy, despite another drop in the unemployment rate, although this hasn’t deterred people from believing they’ll raise rates next week.

Geopolitics to Guide Dollar This Week

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.