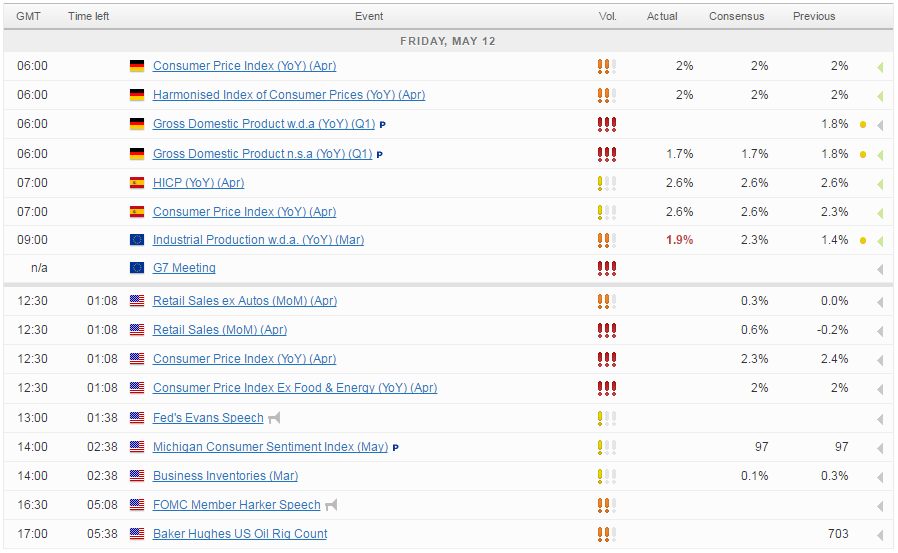

It’s been a relatively flat start to trading on Friday but things should pick up as we approach the US session, with retail sales and inflation data due to be released, among others, and the Fed’s Charles Evans scheduled to appear.

Will Investors Be So Confident on June Rate Hike if Data Doesn’t Rebound?

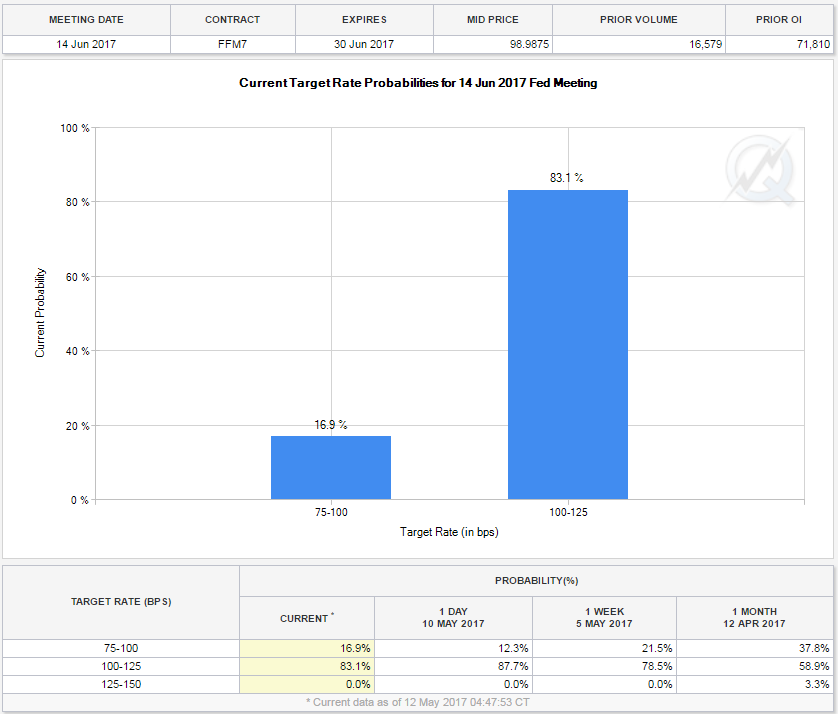

With the Federal Reserve looking to raise interest rates twice more this year and markets eyeing June for the next hike – 83% priced in based on Fed Funds futures – today’s inflation and consumer figures are going to be closely followed.

Source – CME Group FedWatch Tool

While CPI may not be the Fed’s preferred measure of inflation, it will offer insight into whether inflationary pressures are building or the trend of the last couple of months is continuing. That may prove to be a concern for the Fed ahead of the June meeting.

CAC Quiet as French Nonfarm Payrolls Beats Estimate

We’ll also get insight into the US consumer, a very important part of the economy, with the release of retail sales data for April and UoM consumer sentiment data for May being released. It’s been a disappointing couple of months for the US consumer but we’re expecting a rebound this month, with sales seen rising by 0.6%, while consumer sentiment is seen holding at 97, very close to its multi-year highs. The tendency of the US to slow in the first quarter – as noted by the Fed in its statement last week – appears to be once again responsible for the weakness in recent inflation and spending figures, today could offer some insight into whether we’ll see a similar second quarter rebound this year.

Gold Follows Copper and Oil Higher

Will One of the Fed’s Most Dovish Members Support Higher Rates?

Charles Evans speech later today could offer some insight into the June meeting, with him being among the more dovish voting members of the committee. Should he allude to a rate hike next month then it would suggest there’s relatively little opposition and markets are relatively well positioned, although there is still some room for it to be increasingly priced in.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.