It’s been a relatively calm start to trading on Thursday, as we await the latest monetary policy decision, inflation report and press conference from the Bank of England in what has become known as “Super Thursday”.

Higher inflation forecasts and consumer expectations could tempt hawks to favour hike

The monetary policy decision itself is unlikely to offer up any surprises, especially given its proximity to the UK election next month with the central bank not wanting to have any influence on the result. Of course, even in the absence of this, it’s unlikely that policy makers would have voted to reverse any of the measures taken after the EU referendum last June. There was one vote for a rate hike from Kristin Forbes last month but the market clearly doesn’t anticipate that support for this will gather much momentum.

Kiwi Dollar Crash Lands, Loonie Burnt

That said, should the BoE upgrade its inflation forecasts in its inflation report today then it may tempt some of the more hawkish policy makers at the central bank to lean towards voting for a hike. The BoE previously claimed that inflation would peak at 2.8% in the first half of 2018 before falling gradually to 2.4% in three years but with the CPI measure rising quickly and already reaching 2.3%, it may be forced to upgrade these. What could be key is what impact the surge in inflation has had on consumer inflation expectations, which is likely a greater concern for policy makers. Any inclination that this is also rising could tempt one or two policy makers to vote for a hike.

As far as today is concerned, traders appear more focused on the possible path of interest rates going forward, rather than the prospect of one today or even in the near future. There is a belief among many that the BoE will refrain if possible from raising interest rates prior to the end of the two years of Brexit negotiations in an effort to avoid rocking the boat when the economy is already very vulnerable, regardless of what the data since June would suggest.

Oil climbing again after inventory data but gains may be limited

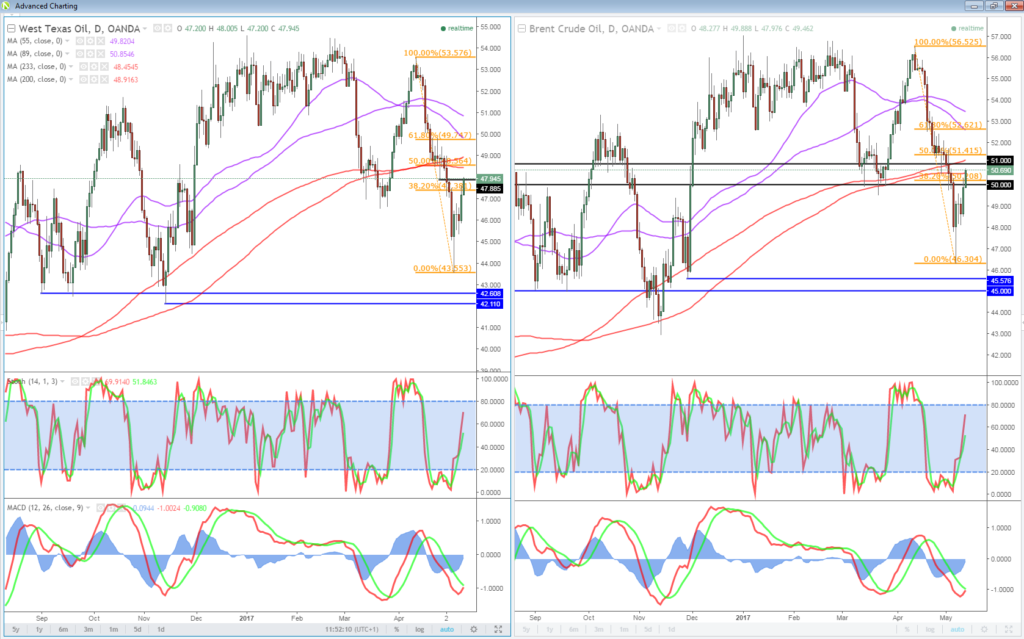

While many markets appear to be in wait and see mode today, oil is rising once again, up more than 1.5% in response to Wednesday’s inventory data. The decline in inventories was much larger than had been anticipated, even if the warning signs were there on Tuesday when API released its own figures. Still, it’s early to say whether this move has lifted oil from a lower range that it appeared to have entered into or provided the opportunity for temporary reprieve. Brent and WTI are both finding some resistance around $51 and $48, respectively, and a move above here could signal a sharper move to the upside. If it holds, it may suggest that momentum remains to the downside.

OANDA fxTrade Advanced Charting Platform

Data Pumps Oil as Gold Deflates

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.