The European session is likely to get off to a positive start on Thursday after French Presidential candidate Emmanuel Macron appeared to edge one step closer to the Elysee, following Wednesday evenings debate with rival Marine Le Pen.

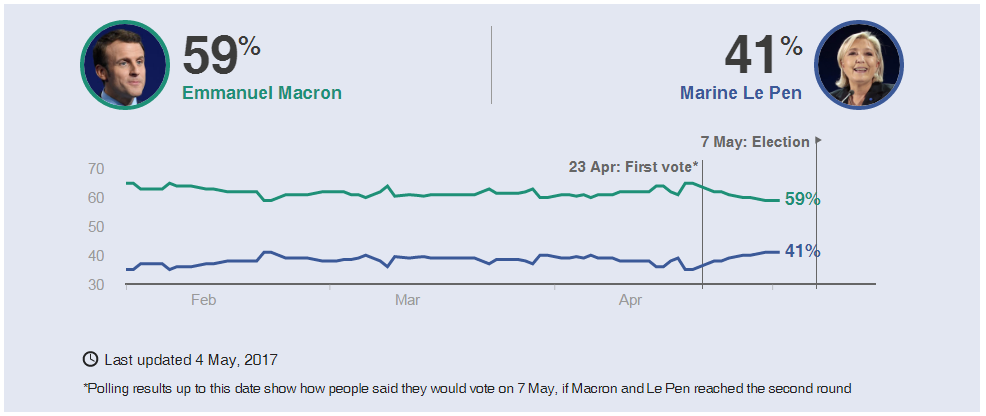

Macron retains poll lead after TV debate performance

With Macron already holding a considerable lead in the polls, the TV debate was Le Pen’s best opportunity to close the gap ahead of voting on Sunday. While Le Pen was widely seen as being better suited to the event, it is Macron that is believed to have fared better in the scathing encounter, helping to protect his substantial lead in the process and ease concerns about a late surge by the National Front leader.

The FOMC provided some unexpected impetus

While we have seen Le Pen risk abate in recent weeks as her lead in the polls slipped and Macron took the first round, the spread between French and German 10-year yields remains at the top end of the range it traded at prior to the election premium being priced in. If this is also being reflected elsewhere then there may be potential for a small relief rally next week, should Macron win as expected.

Source – BBC

*The polling average line looks at the five most recent national polls and takes the median value, ie, the value between the two figures that are higher and two figures that are lower.

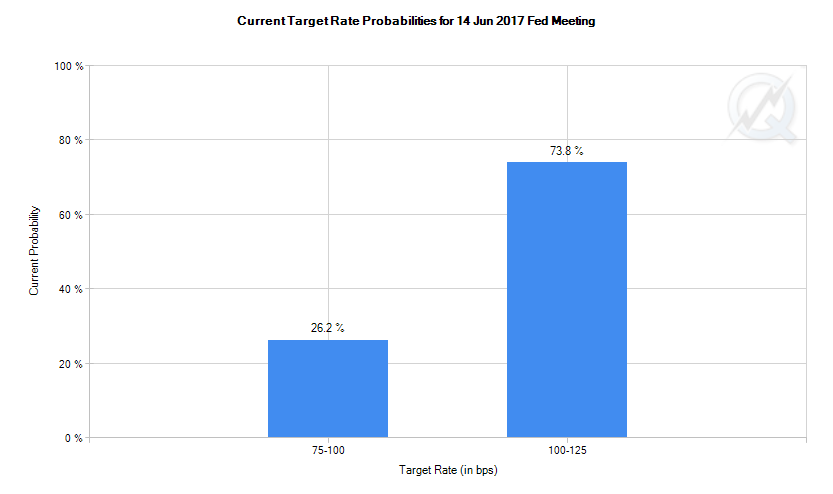

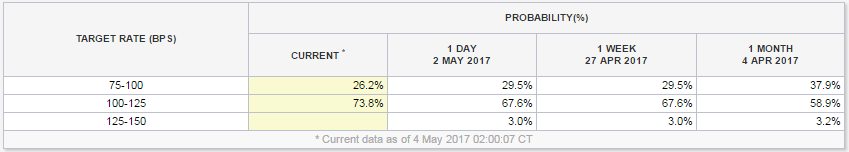

Gold hit by Macron risk rally and dollar gains as Fed hints at June hike

Gold has been dealt a double blow over the last 24 hours, with the post-debate boost to risk appetite and stronger dollar weighing on the yellow metal. The gains in the dollar came as the Fed indicated that it is willing to look through the first quarter weakness which it views as “transitory”, a sign that a second rate hike this year in June very much remains on the table. Markets are now pricing in a 74% chance of a hike next month, up from 68% prior to the statement.

Source – CME Group FedWatch Tool

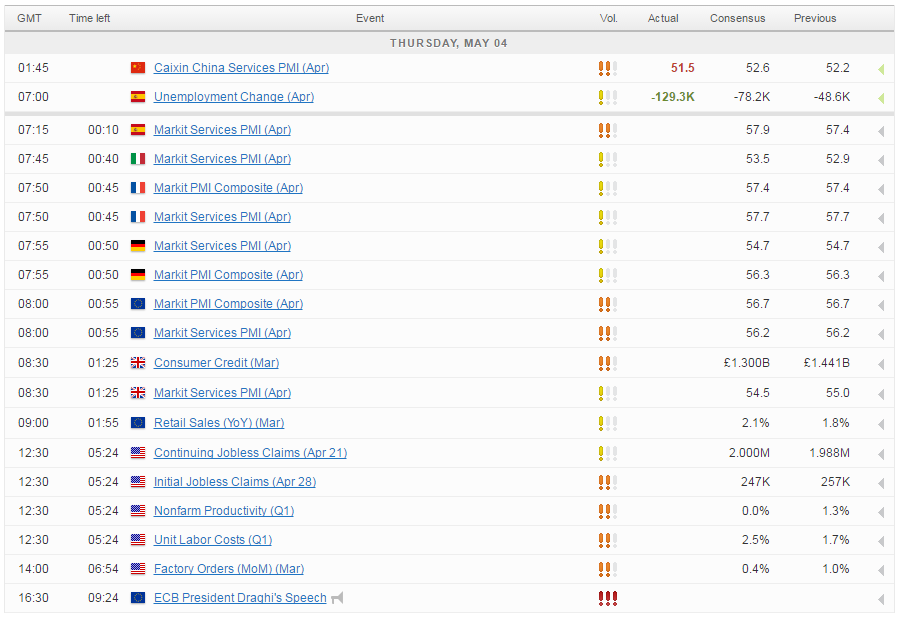

Numerous data releases to come throughout the day on Thursday

With arguably the two biggest events this week now behind us, attention will turn to Friday’s jobs report which will offer our first insight into how the US rebounded in the first month of the second quarter. Prior to that though, there is a lot of economic data to come today with services PMIs across Europe being released throughout the morning, followed later this afternoon by jobless claims, productivity, labour costs and factory orders data from the US.

USD/CAD Canadian Dollar Flat After Fed Holds Interest Rate

This morning’s Chinese Caixin services PMI got us off to a rocky start but whereas the world’s second largest economy is widely expected to slow following a bumper first quarter, data so far this week suggests confidence in Europe is on the rise.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.