The DAX has posted gains in the Thursday session, as the index trades at 12,632.50. On the release front, German and Eurozone Services PMIs continued to show expansion and were above expectations. Later in the day, ECB President Mario Draghi will speak at an event in Switzerland. On Friday, the Eurozone publishes Retail PMI, and the US releases wage growth and nonfarm payrolls reports.

The eurozone has enjoyed a solid first quarter, and more growth has meant more jobs and lower unemployment figures. Just a year ago, the eurozone unemployment rate was at 10.3%, but the rate has been steadily decreasing since then. The March release remained unchanged at 9.5%, within expectations. Germany has led the way, with the unemployment rate dropping to 5.9% in February. Unemployment rolls continue to shrink in Germany, and the decline of 15,000 unemployed persons was better than the estimate of 10,000. Services PMI reports for March have also looked solid, with the Eurozone and Germany releases pointing to expansion.

There were no surprises as the Federal Reserve stayed on the sidelines on Wednesday, holding the benchmark rate at 0.75 percent. However, the Fed rate statement was hawkish, as policymakers emphasized the positives and downplayed a soft first quarter. The statement noted that consumer spending remains strong and that inflation was “running close” to the Fed’s 2 percent target. The Fed’s message is clearly one of optimism, as the central bank remains on track to raise interest rates twice more in 2017. The Fed’s bullish statement immediately raised the likelihood of a rate hike at June meeting, which jumped to 74 percent after the statement, up from 63% before meeting. The Fed has two key goals which have been achieved, namely full employment and an inflation rate of 2%. One area of concern is the balance sheet, which stands at $4.5 trillion. The minutes of the March meeting stated that policymakers want to start reducing this figure before the end of 2017, and we could see another reference to the balance sheet in the April minutes.

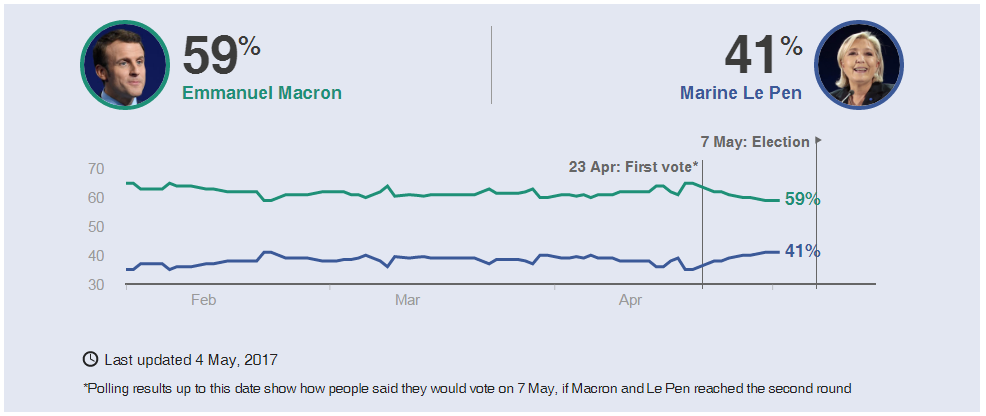

Emmanuel Macron and Marie Le Pen faced off in a television debate on Wednesday, ahead of the French election on Sunday. Polls after the feisty debate showed that about 60% of viewers felt Macron had won, which mirrors current opinion polls ahead Election Day. Macron had the most to lose from the debate, but he kept his cool and acted presidential, in contrast to Le Pen. Barring a dramatic event in the next few days, such as a terror attack, all signs are pointing to Macron becoming France’s next president. The presidential election will be followed by parliamentary elections in June.

Macron has Euro Markets on Firm Footing

Source – BBC

The polling average line looks at the five most recent national polls and takes the median value, ie, the value between the two figures that are higher and two figures that are lower.

Source – BBC

French Election Timeline

May 3 – TV debate between the two remaining candidates

May 5 – [from midnight] Poll blackout

May 7 – Second round of French presidential elections. Last polls close at 19:00 BST / 14:00 EDT, with an exit poll result announced immediately.

May 11 – Official proclamation of the new President.

May 14 – [from midnight] End of Francois Hollande’s mandate

June 11 – First round of legislative elections

June 18 – Second round of legislative elections.

Economic Calendar

Thursday (May 4)

- 3:55 German Final Services PMI. Estimate 54.7. Actual 55.4

- 4:00 Eurozone Final Services PMI. Estimate 56.3. Actual 56.4

- 5:00 Eurozone Retail Sales. Estimate 0.1%. Actual 0.3%

- 12:30 ECB President Mario Draghi Speech

*All release times are EDT

*Key events are in bold

DAX, Thursday, May 4 at 7:00 EST

Open: 12,551.00 High: 12,634.50 Low: 12,533.50 Close: 12,632.50

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.