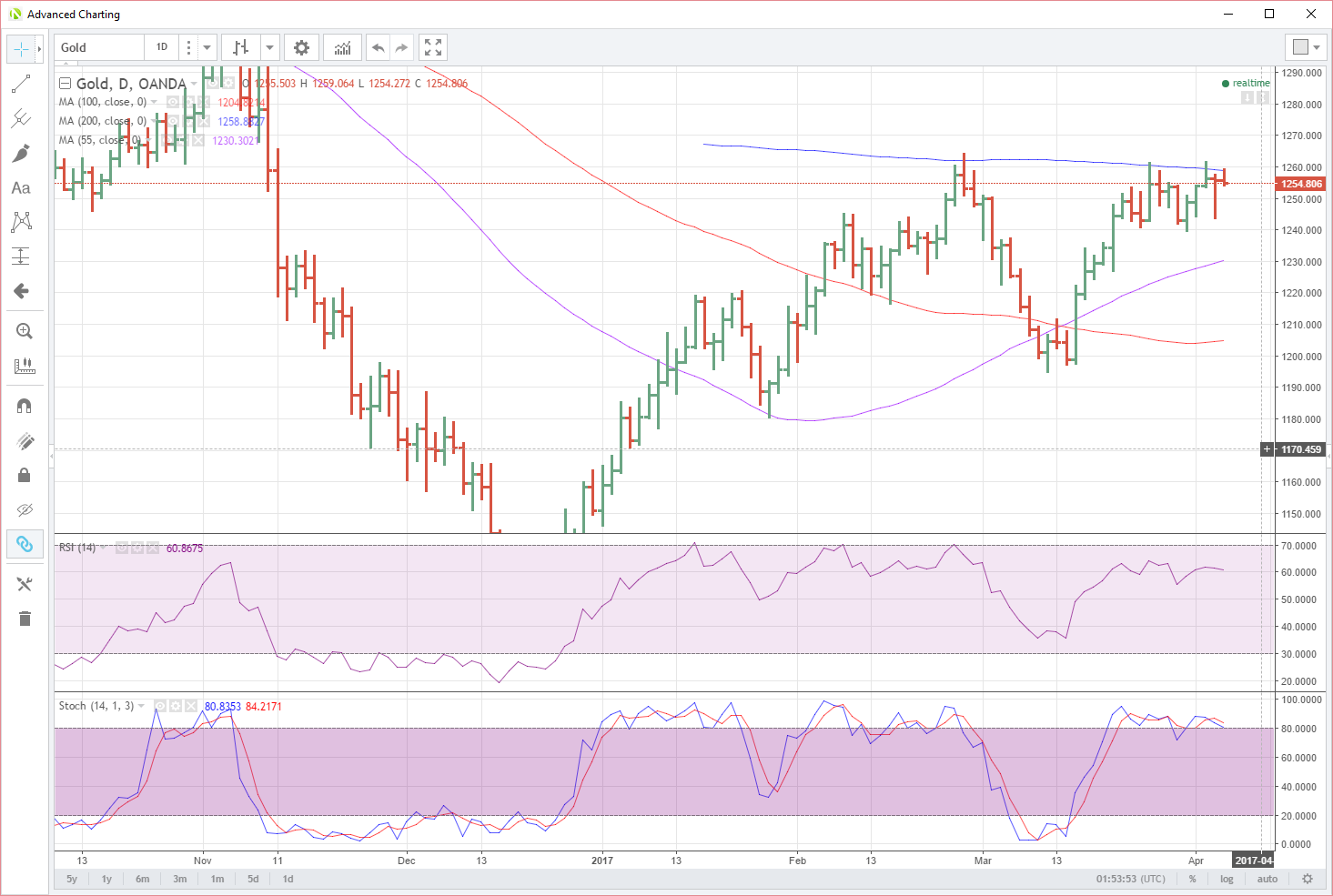

Gold rallied initially overnight on risk aversion ahead of the Trump/Xi meeting, only to fail once again at the 200-day moving average which sits at 1259 in Asia today.

GOLD

Gold’s jitters were probably caused by the FOMC minutes discussing the start of the rundown of the Federal Reserve’s balance sheet this year. This should imply higher yields, and although the bond market hasn’t reacted (yet), both equities and gold did, by falling from their highs.

1259 and the 1261.50 levels make up initial resistance in gold today, with the 1240 level still the key support as gold trades at 1255 an ounce in early Asia. A break of the 1240 support would be of particular concern to gold bulls now given the multiple failures above.

Silver

We also note that silvers’ magic run higher may be losing some steam in the short term. We note bearish divergence between spot silver and its daily RSI and Stochastics.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.