It’s been a relatively slow start to trading on Friday, with the final day of the week also falling on the final day of the month and quarter which can often result in rather uneventful markets as we await any final quarter-end portfolio rebalancing.

The final hours of the week could be quite active though as final rebalancing occurs and with a number of important pieces of economic data being released at the same time, it could make for an interesting end to the day. The inflation outlook in the US, while being on track to hit the Federal Reserve’s 2% target, continues to be the main reason behind the cautious tightening cycle that the central bank has embarked on and today we’ll get some important figures on just that.

EUR/USD – Euro Yawns on Mixed Euro Data

The core PCE price index is the Fed’s preferred measure of inflation and currently lingers below its target at 1.7%, well below the core CPI equivalent which is actually above target. Any increase today would surely increase the possibility of a rate hike in June, especially with the Fed having to consider the possibility of substantial fiscal stimulus towards the end of the year.

A key contributor to the inflation outlook that has been lacking since the financial crisis is higher wages and spending, two more areas that we’ll get insight on today. Personal income and spending figures will be released alongside the inflation numbers and are expected to be relatively consistent with what we’ve seen in recent months. This should ensure the tightening cycle remains gradual and doesn’t risk choking off the ongoing recovery in the economy.

Gold Slips Below $1250 on Strong GDP Report

We’ll also hear from a couple of Fed policy makers today, with James Bullard and Neel Kaskari – the most dovish of the voting members of the FOMC and the only one to have to dissented to a hike in March – both appearing throughout the day. Both appear after the release of the inflation, earnings and spending data so we may get early insight into their views on the numbers, particularly Kashkari’s given that inflation being below target was a major factor in his decision to dissent.

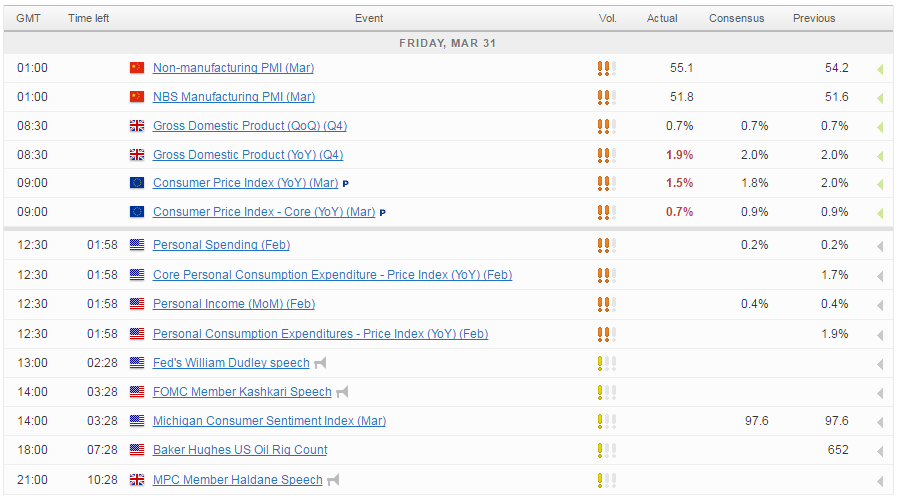

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.