US equity markets are expected to open a little higher on Tuesday, tracking broad gains in Europe where only the FTSE is currently trading lower, as sterling’s strong gains way on the outward looking UK index.

GBP flying as higher CPI supports calls for rate hike

The British pound is flying this morning after inflation data for February showed prices are rising much faster than thought, with both the CPI and core CPI measures now in line or above the Bank of England’s target. The spike in the inflation numbers probably explains why some BoE policy makers turned far more hawkish at the last meeting, with one voting for a rate hike and others suggesting they could soon follow.

USD/CAD – Canadian Dollar Edges Higher Ahead of Canadian Retail Sales

The pound had been under a lot of pressure last week and was threatening to break below the 1.20-1.21 support zone that has held firm over the last five months. With the BoE signalling previously that it would tolerate above target inflation, traders were looking through the increases in the data and instead focusing on other data weaknesses that were appearing and the possibility of hard Brexit. With the BoE now indicating it could raise rates much sooner than markets were expecting in response to the inflation data, future downside for the pound now looks far more limited, especially as it’s the pounds depreciation that has generated much of the inflationary pressures.

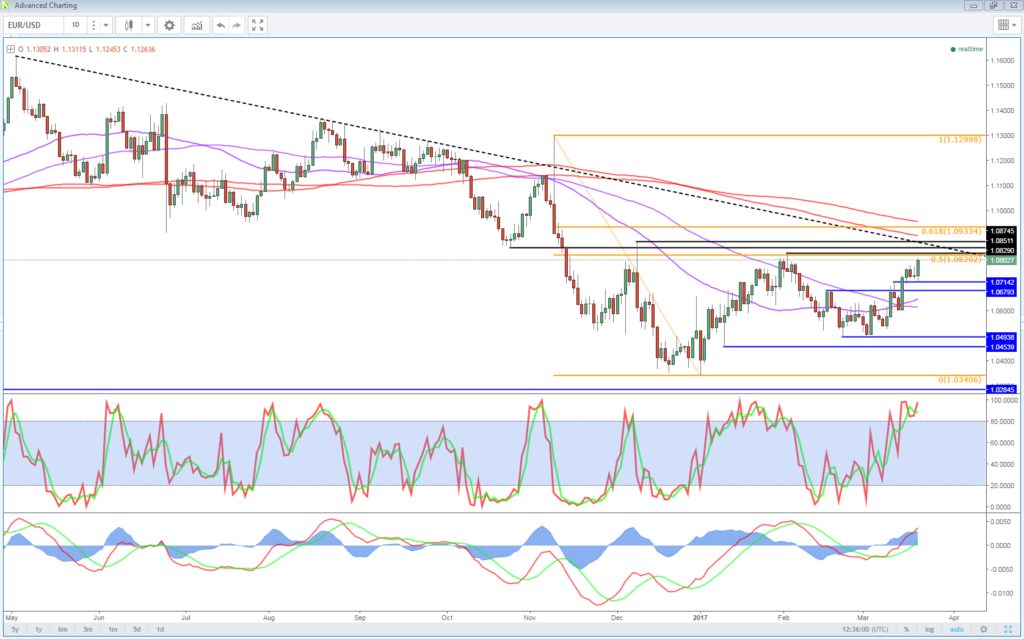

OANDA fxTrade Advanced Charting Platform

EUR En Marche after Macon’s Presidential debate performance

The euro is also making some decent gains against the greenback this morning after a number of polls showed Emmanuel Macron performing best in last night’s Presidential debate. Macon is seen as the more market friendly candidate, particularly among the two frontrunners, with Marine Le Pen threatening to pull France out of the euro. While Le Pen still leads in first round polls, Macron is seen by most polls to have a comfortable lead in the second round. Markets continue to price in Le Pen risk, with French 10-year yields still at an early-2014 premium to their German counterparts, but results like last night are offering some reprieve. While the Dutch elections may have gone relatively smoothly as far as markets are concerned, I don’t think people will get too complacent ahead of the 23 April and 7 May votes in France after what they experienced last year.

Fed Speeches eyed as USD remains in correction mode

The US dollar remains in correction mode this morning, largely driven on this occasion by gains elsewhere but also aided by the more dovish than expected language that followed last week’s rate hike. As other central banks becoming slightly more hawkish as the environment becomes more inflationary and economic and political risks subside, the pace of dollar appreciation should slow. That said, I still expect the Federal Reserve tightening cycle to be much more aggressive than other central banks over the next couple of years which should be supportive for the dollar during that period.

EUR Takes Flight, Pound Supported by Inflation Data

With economic data releases looking thin again today, focus will remain on the US central bank with three policy makers scheduled to make appearances. Of those appearing, William Dudley’s will be of most interest, with him being the only voter on the FOMC among them and his views closely correlated with those of Chair Janet Yellen. We’ll also hear from Esther George and Loretta Mester, both of whom are seen as being among the more hawkish of the Fed officials. As always, policy makers have been relatively non-committal on the next rate hike since last week’s meeting and I expect more of the same today. Investors continue to expect two more rate hikes this year, although the odds have slipped slightly since last week and June is just above 50% for the next hike, with two by December being also just above 50%.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.