Is Friday’s Jobs Report Key to a Rate Hike or Just a Bonus?

Friday’s US jobs report is widely regarded as the final piece of puzzle when it comes to a rate hike next week and following Wednesday’s phenomenal ADP reading, it may very well nearly be in place.

Job creation has long not been a problem for the US, with the country averaging more than 200,000 new jobs each month over the last five years. Even last year when unemployment was at or below 5%, very close to what the Fed deems full employment, the US was creating just shy of 190,000 jobs each month.

With the labour market getting quite tight now, the Federal Reserve is desperate not to fall behind the curve on inflation and risk having to raise interest rates too quickly further down the line. Given the recent commentary from officials, it seems like the time has come for the first of potentially three rate hikes this year and one final stellar jobs report could seal the deal.

USD/CAD Climbs to 2017 High, Canadian Employment Change Next

Of course when it comes to the Fed, we can never be 100% confident about what they’re going to do. They’ve surprised us in the past and they will do again in the future. But the clearly coordinated efforts to lead markets in recent weeks would strongly suggest a rate hike is coming next week.

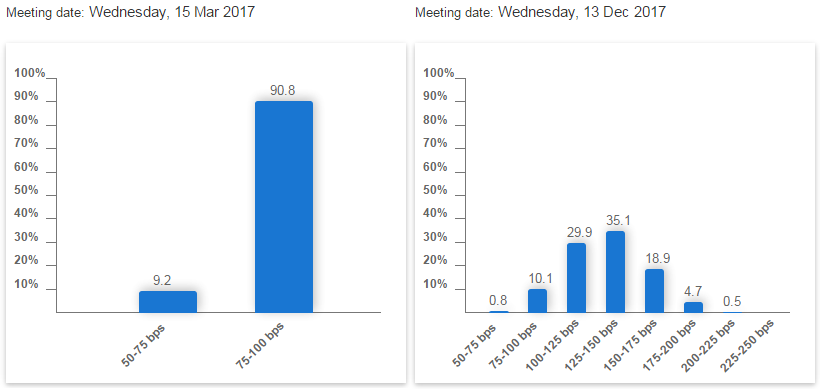

Financial markets have gone from all-but pricing out a rate hike next week – the implied probability was close to 10% at times last month – to almost fully pricing it in. The implied probability of a rate hike next week is currently 89%, with three by the end of the year priced at 59%. It’s been a long time since the Fed and the markets have been so on the same page.

Source – CME Group FedWatch Tool

So What Should We Expect on Friday?

With all of this in mind, the chances are it would take something quite appalling on Friday to change the Fed’s mind next week and given Wednesday’s ADP reading – a staggering 298,000, the highest in almost three years – I think that’s unlikely.

Ultimately, a strong jobs report on Friday would make the Fed’s job a lot easier next week. The headline numbers are always going to be the non-farm payrolls and unemployment figures, both of which are expected to be very good. Average earnings is arguably the most important at the moment if the Fed wants to see sustained inflation but this has been on a positive trajectory for a couple of years and is unlikely to take a turn for the worse given the strength of the labour market.

Oil Tumbles For Second Day, ECB in Focus

From a traders perspective, it’s worth noting that while near-term expectations matter, the longer term is also very important and so a report that shows the economy is on the right path and on course for three rate hikes this year may be enough to sustain the US dollar and lift Treasury yields.

For charting analysis ahead of the report, check out our NFP video.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.