The ECB is stealing the spotlight temporarily from the Federal Reserve today as it announces its latest monetary policy decision and hopefully offers some guidance for the rest of the year.

While inflation in the eurozone is currently running above the ECBs target of below but close to 2%, core inflation is still well below and the base effect in commodities is broadly responsible for the moves in the headline figure. What’s more, while the economy is showing signs of improvement, it’s still too early to remove accommodation again, having only cut its asset purchase program by €20 billion in December, a move that only comes into effect after this month.

The ECB will also likely want to keep a low profile ahead of the upcoming elections in the Netherlands and France. The most popular parties in these countries are strongly anti-euro and want to pull their respective countries out of the currency union. The last thing Draghi will want to do is rock the boat ahead of these crucial votes, especially if there’s absolutely no reason to do so. That said, in the press conference after, we may get some insight into what the central bank intends to do later this year when the current quantitative easing program expires. This is what will create waves in the markets, assuming he gives anything away of course. I think it’s more likely that he’ll refrain from letting much go at this early stage but highlight the improvement in the data and possible reduction in downside risks.

The euro is trading a little higher ahead of the ECB decision, having spent the last three days in the red. Still, it continues to linger around its two month lows against the dollar, with 1.05 still offering significant support. Against the pound it’s been a little better supported but this may largely be due to the weakness in sterling more so than strength of the euro. It continues to struggle against the yen, with safe haven flows continuing to support the latter. With all this in mind, the euro may be susceptible to some decent upside, should Draghi strike a more hawkish tone.

OANDA fxTrade Advanced Charting Platform

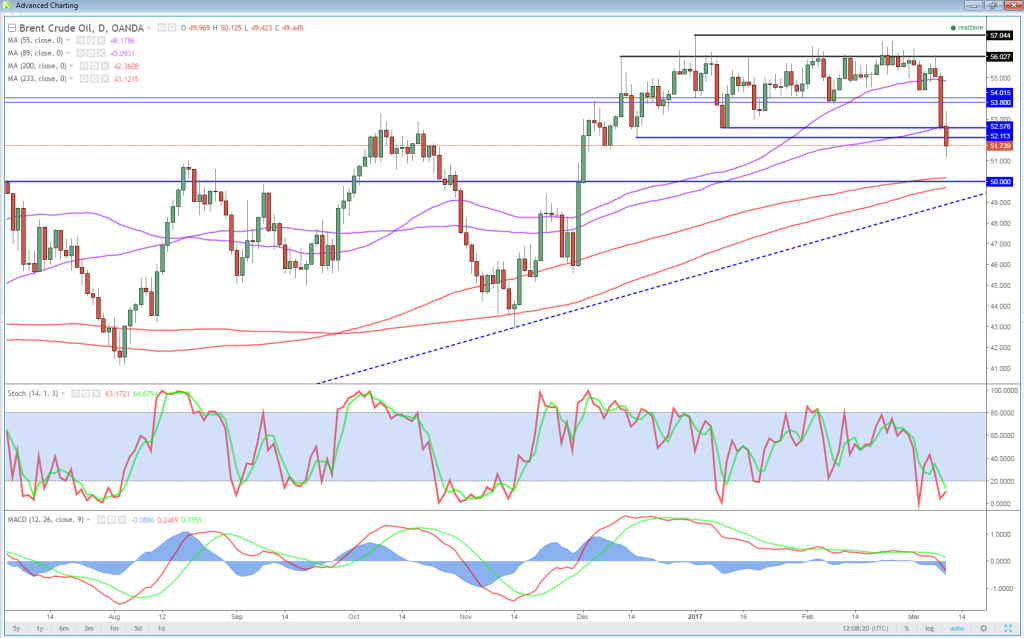

Oil has been the biggest mover this morning, with Brent and WTI both down by more than 2.5%. This week’s large inventory build, the third substantial increase in four weeks, really appears to have hit home in the markets, triggering some significant losses over the last 24 hours and a break below the range it had traded within for the last three months. With the downside now taken out, we could well see further losses ahead for Brent and WTI, with $50 and $47.35 being the next major tests. Oil producers may have been patting themselves on the back in recent months about the success of the output cut, with compliance much higher than many expected, but with prices looking weaker once again, an extension to the deal may be more of a necessity than an option.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.