US futures are pointing slightly lower again on Monday as the Dow looks to extend its winning streak to 12 straight sessions having come close to ending it on Friday.

The markets are continuing to find a way to squeeze out new highs and post small gains on a daily basis, a large portion of which appears to be attributable to the apparently substantial but as yet unknown stimulus measures from the Trump administration. Donald Trump and his team have certainly not shied away from talking up the upcoming plans for tax reform and regulatory changes which is so far keeping markets elevated but I wonder if we’re getting to a point at which he’s at risk of not being able to meet the now high expectations.

Dollar Crippled by Trumps Inaction

Trump’s appearance before Congress will be watched very closely for some real insight into his plans for taxes and possibly fiscal stimulus which would help to sustain the rally for now. Given the lack of details so far though, I’m not getting my hopes up. In the absence of any details, Trump may instead hope to rely on the very tactics that have been so successful so far, vague yet substantial promises that keep people interested while leaving us all none-the-wiser.

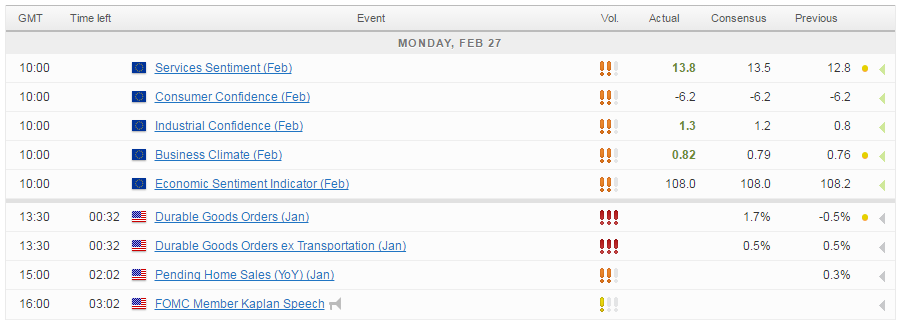

As for today, we’ve got some economic data being released, including the all-important core durable goods orders, which may help sustain the broadly positive sentiment in the markets and we’ll also hear from Robert Kaplan, a current voter on the FOMC who has been one of the more cautious hawks of late. A rate hike in March is still far from being priced in by the markets, despite the odds having risen quite considerably at times over the last month.

DAX – Under Pressure as Trump Speech Looms

It’s been a relatively quiet session so far today but it is interesting that oil is once again pushing higher and threatening to break above near-two month trading range. The line in the sand continues to be $54.50 in WTI and $57 in Brent, with a break above these bringing $55.65-56.65 and $59.25, respectively, into focus.

OANDA fxTrade Advanced Charting Platform

Momentum still appears to be with the bulls, despite the inability over the last week to break down the resistance after numerous attempts.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.