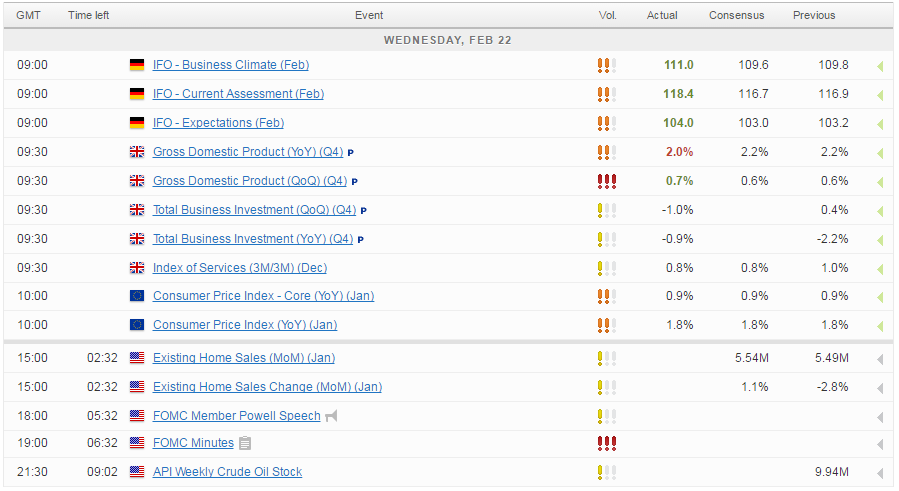

Wall Street is on course for a relatively flat open on Wednesday as traders look ahead to the release of the FOMC minutes from the last meeting for hints on the timing of the next rate hike.

Prior to Janet Yellen’s testimony before Congress last week, investors had all but written off the possibility that we’ll see a rate hike in March but the repeated insistence from the Chair and numerous other officials since that a hike is on the table, appears to have had the desired impact. That said, the odds of a rate hike are still well below the level that many see as being necessary for the Fed to actually trigger such a move – generally seen as above 70% – so there’s still plenty of work to be done if the markets are going to fully buy in.

USD/JPY – Yen Improves to 113, Fed Minutes Next

Given that the meeting was accompanied by a press conference and the number of Fed officials we’ve heard from since, the minutes may very well offer very little that we’re not already aware of. If a hike in March is in fact is a strong possibility then we’ll want to see a strong consensus indicating so in the minutes, otherwise there may be very little that they can actually add. It may therefore be Jerome Powell – a permanent voter on the FOMC – who has a greater influence on expectations when he speaks today. Should he add his name to the list of voters seriously considering a hike in March then markets should adjust accordingly, which could be bullish for the dollar – already up for a fourth consecutive day – and bearish for Gold.

OANDA fxTrade Advanced Charting Platform

Gold is trading marginally higher today but continues to show significant resilience in the face of dollar gains. Ordinarily, Gold has a relatively strong inverse relationship with the dollar and yet it’s trading near more than three month highs and has not been wounded by the dollar’s rally in recent days. Instead it appears to have stabilised just shy of $1,250 which is the next big barrier to the upside.

Dollar Produces Mixed Results Ahead of Fed Minutes

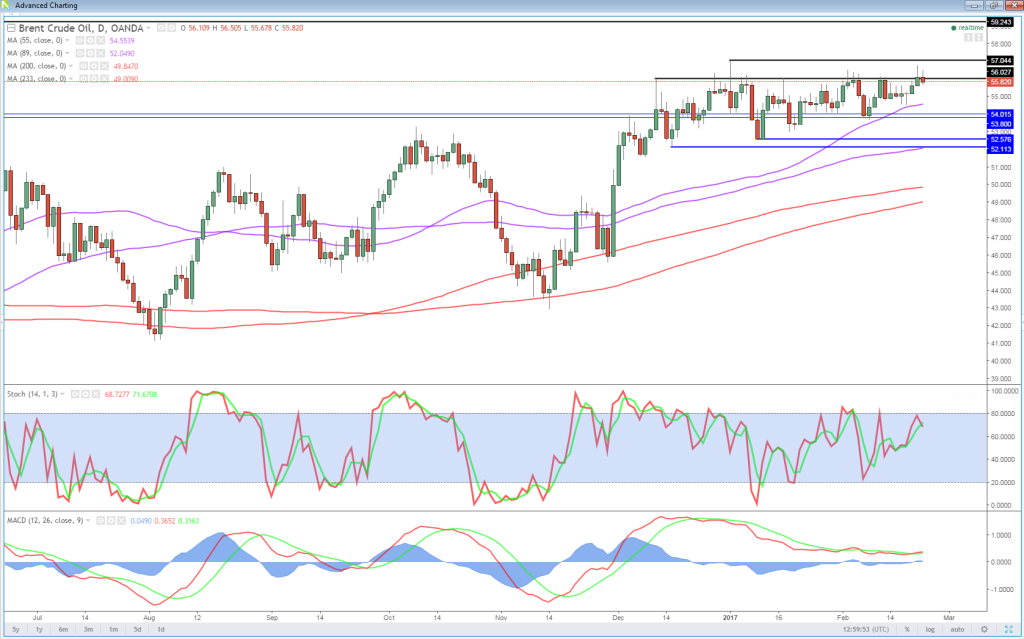

Oil is trading slightly lower on the day having threatened to break above the trading range it has been contained within for most of the year so far. Both Brent and WTI had looked on course to break through the upper end of the range at times and the latter did briefly trade at six week highs but the resistance proved too strong on this occasion.

Given that these levels are being tested even as we’re seeing rising US production and oil rigs, not to mention some substantial inventory gains, suggests to me it may have legs and $59 Brent and $57 WTI may not be too far away. Clearly traders are impressed with the level of compliance in the production cuts and see this as far exceeding what’s happening in the US and inventory builds as being only temporary.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.