European equity markets are expected to open higher on Monday, although trading is likely to be relatively light given the US bank holiday which helped drive similar conditions in Asia overnight.

It would appear we’re still in a kind of trance at the moment whereby equity markets continue to shuffle higher in the hope that Donald Trump will deliver on his fiscal stimulus, tax and deregulation plans and yet, there’s no conviction in the rally’s. This isn’t overly surprising given the amount of political risk at the moment but you wonder how much longer we can remain in this state before we wake up.

That’s not necessarily to say markets are going to collapse or even enter correction but I think we’re nearing the point at which investors may start demanding something a little more concrete. It’s difficult to ignore the moves in Gold and the yen alongside this which typically accompany more risk averse conditions. Perhaps it just reflects underlying uncertainty which is a concern.

Gold is actually trading a little lower so far today having interestingly failed to break above the high from 8 August, despite coming very close. The next big test for Gold will now come around $1,216.73, last week’s lows, with a break through here possibly triggering a move back below $1,200 towards $1,180.63.

OANDA fxTrade Advanced Charting Platform

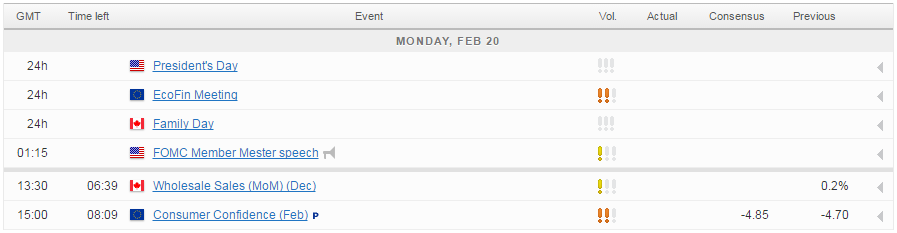

As mentioned above, with it being a bank holiday in the US today, we could be looking at a slightly quieter session. We have some scatterings of low level data throughout the day but nothing that I would expect will cause too much of a jolt in the markets. The Reserve Bank of Australia minutes from its recent meeting, released overnight, will likely be the next event of note.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.