US equity markets are looking to build on Thursday’s record highs in all three major indices, with futures indicating another higher open on Wall Street today.

US President Donald Trump has started making the right noises again as far as markets are concerned, with Thursday’s promise of a “phenomenal” tax announcement in the coming weeks certainly hitting all the right notes. Investors have become a little apprehensive in recent weeks due to the unpredictable nature of Trump’s policies and the timing of the announcements which has taken the edge of moves we saw heading into year end.

Of course, we’re still seeing indices trading at record highs but the moves are lacking conviction. You get the feeling that investors aren’t exactly ready to abandon ship just yet but they’re not fully on board either. Trump’s change of stance on the “One China” policy in a phone call with Xi Jinping is another welcome move from the President and it hopefully lays the groundwork for better relations between the world’s two largest economies, something that has been far from guaranteed and still is. Hopefully this is a positive step forward.

The next test for Trump will be his meeting today with Japanese Prime Minister Shinzo Abe. A number of topics are due to be discussed at the meeting, many of which Trump was critical of, when it comes to Japan, throughout his campaign and since. One of the major concerns with Trump’s Presidency is his relationships with other leaders and whether it will damage trade and cooperation, something we’ll hopefully have a better idea of after today’s meeting.

USD/JPY – Dollar Climbs Close to 114 on Strong Jobless Claims

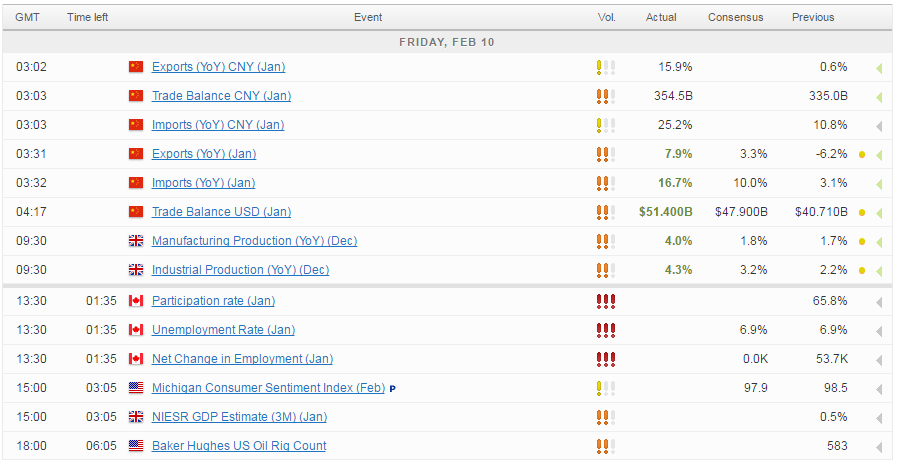

The economic calendar is once again looking a little bare, as has been the case for most of the week. UoM consumer sentiment stands out as being the key economic release today, with spending being such an important part of the US economy and crucial to the Fed sustainably hitting its 2% inflation target. We’re expecting a small drop in the number today but even so, it is expected to remain around the same levels to those prior to the global financial crisis. We’ll also get a UK GDP estimate for the three months to January from NIESR today, with growth in the period seen at around 0.5%, not bad at all under the circumstances.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.