It’s been another relatively quiet start to trading on Thursday, very much in keeping with what we’ve seen throughout the week so far with the absence of major economic data or events offering little direction for traders.

The only event of note so far today came from New Zealand where the central bank signalled its intention not to raise interest rates until 2019, catching traders off guard with markets having priced in at least one hike this year. It seems the Reserve Bank of New Zealand is not quite as optimistic on the outlook as markets were expecting and its belief that the currency remains overvalued will only dampen its views. The New Zealand dollar has pared some of its earlier losses but still remains off more than one cent against its US counterpart.

Oil is trading up more than 1% on the day having recovered from its inventory-induced sell-off over the last couple of days. A huge inventory build over the last week, as reported by API and EIA, cast further doubts over whether efforts by OPEC and non-OPEC members to cut production will fully address the oversupply issue that has crushed oil prices in recent years. The re-emergence of US shale oil as prices have rebounded from their lows appears to be offsetting the cuts apparently being imposed as part of the production cut deal and questions are also surfacing about whether demand growth is as strong as expected. Still, oil is edging higher this morning despite all of this having reached the bottom of its trading range. Clearly it’s going to take more than a large inventory build to seriously test these lows.

OANDA fxTrade Advanced Charting Platform

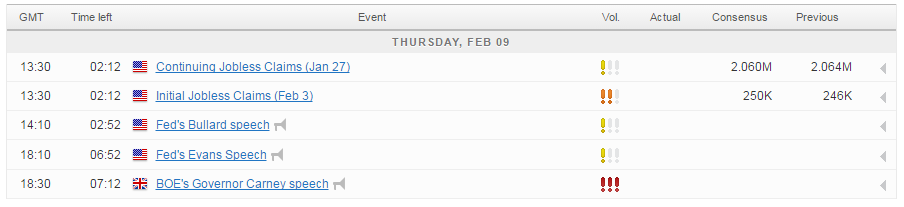

In general we continue to see plenty of caution in the markets which is likely attributable to the large amount of political risk and the unpredictability on Donald Trump is the early days of his tenure. Jobless claims is the only notable economic release to come today but we will also hear from Charles Evans and James Bullard, two Fed officials the first of which is a permanent voter on the FOMC. While markets have all but priced out a rate hike in March, it will be interesting to see if the Fed is on the same page.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.