European equity markets are positioned to open a little higher on Tuesday but traders appear to still be operating with caution as Donald Trump’s actions draw focus to the less market friendly aspects of his campaign that investors until now have overlooked.

Trump noted on Monday just how well the markets have performed since his election victory back in November but in that time, there has been a strong focus on his promises of fiscal stimulus, deregulation and tax cuts, all of which are supportive for markets. His actions over the last few days is another reminder that there were two sides to his campaign and Trump is just as adamant to follow through on those measures that will likely weigh on market sentiment in the coming months.

While we may be expecting a small bounce in European markets this morning, there appears to still be a sense of risk aversion carrying over from the US and Asian sessions, with the safe haven yen once again trading higher and Gold trading back above $1,200 having come off its recent highs over the last week.

OANDA fxTrade Advanced Charting Platform

The yen gains may have been slightly aided by the Bank of Japan’s more optimistic forecasts for growth following its meeting overnight. The central bank raised its outlook for growth and reiterated its belief that inflation will reach its 2% target around March 2019, while warning that risks to both are skewed to the downside. Governor Haruhiko Kuroda will likely be quizzed on one of those risks, Trump, when he appears for his press conference shortly.

XAU/USD – Gold Edges Higher, Consumer Confidence Ahead

We’ll also hear from ECB President Mario Draghi this morning when he appears in Frankfurt. Draghi’s appearance will come just ahead of the latest flash inflation figures for the eurozone which are likely to show overall prices rising by 1.5% but importantly core prices remaining unchanged at 0.9%. The pressure for the ECB to further reduce asset purchases has increased over the last month or so as German inflation has moved back to target and euro area inflation has increased but it’s important that the central bank doesn’t respond to temporary price movements and risk choking the recovery, particularly in the vulnerable periphery.

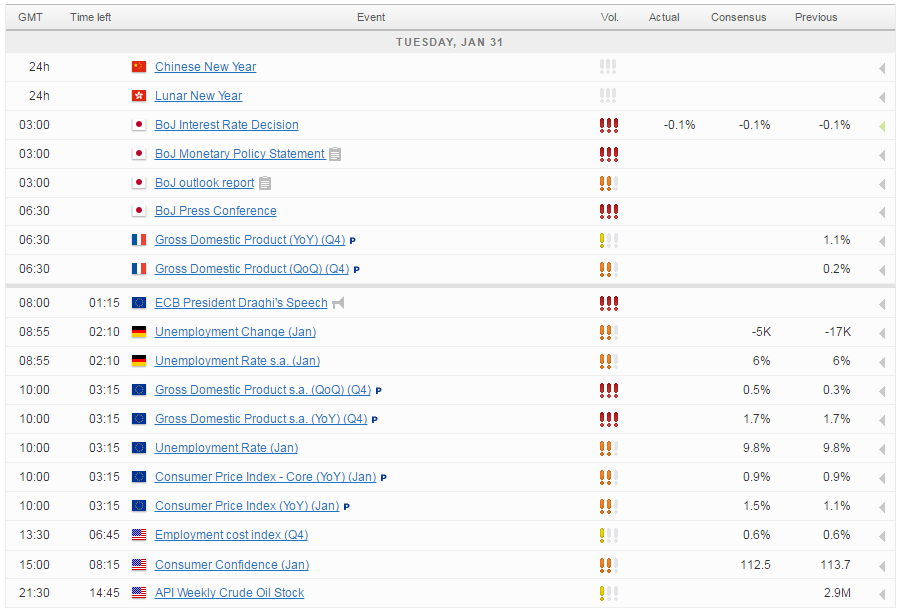

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.