Today’s US jobs report may not be the most eagerly anticipated in years but with markets as volatile and, some may argue, vulnerable as they are, we could be in for an eventful end to the opening week of the new year.

The Federal Reserve raised interest rates by another 25 basis points in December and laid out plans for another three hikes in 2017 as it continues to steer the US through a decade long recovery from the global financial crisis. Markets have largely bought into the Fed’s expectations for interest rates this year and with the last rate hike having only just happened and the next not penciled in until the middle of the year, it would not be outrageous to suggest that the December jobs numbers are not the most important we’ve had for some time.

Markets Have Bigger Troubles Than NFP

That said, it would be naive to think that because of this the markets will not be volatile around the release. For a start, markets have started the year on a volatile footing and while they may be relatively calm this morning, this is a greater reflection of traders hesitancy in the build up to arguably the most important monthly numbers, than there being a lack of catalysts out there. The movements in the dollar over the last 48 hours are testament to this, I would not be surprised to see similar levels of volatility should the numbers miss expectations, particularly to the downside.

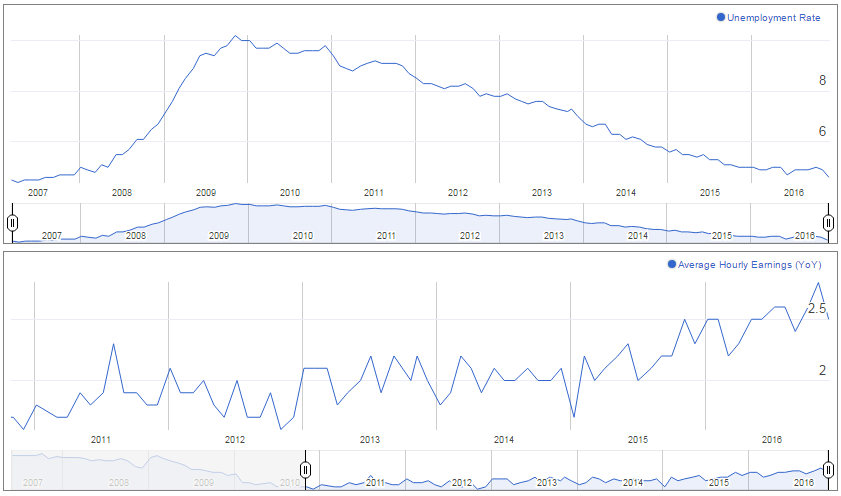

It’s also important to remember that interest rate expectations change all the time and there was clear concern in the FOMC minutes about the potential to undershoot the level that unemployment should settle around in the long term. The potential for inflationary pressures to build in this scenario is a risk for the Fed that would force it to raise interest rates at a faster pace than it is currently forecasting and would ideally like. With unemployment already at 4.6%, this is something investors will be very aware of if we continue to see strong jobs numbers, particularly if these are accompanied by rising wage growth.

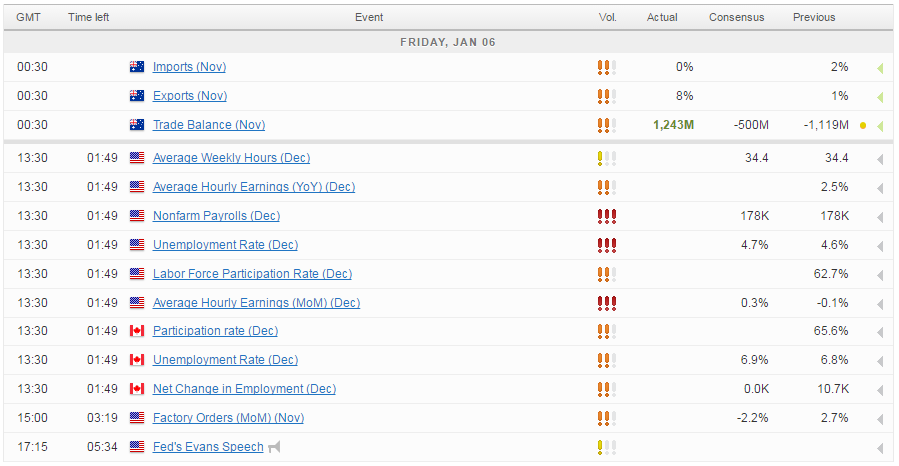

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.