US futures are pointing to a slightly higher open on Wall Street on Wednesday, with the Dow once again headed back towards the 20,000 level that has thus far eluded it.

The festive cooling off period appears to have passed and the Dow has resumed its slow grind back towards the psychologically important level. The optimism that was so prevalent in the lead up to the festive period appears to still be there in the markets, albeit possibly to a lesser extent. It just remains to be seen whether the economic data, which has been good so far this week, can provide the catalyst to take us to the next level.

Precious Metals Shrug Off A Stronger Dollar

The jobs report on Friday will be the standout release this week but there’s plenty of other things to focus on in the meantime, including ADP and PMI number tomorrow and FOMC minutes today. The Federal Reserve raised interest rates for only the second time in a decade in December and the only time in 2016 but warned that three more could follow this year. While this exceeded market expectations at the time, investors have since been undeterred by more rate hikes which would suggest there’s more faith in the recovery, aided most likely by the expectation of fiscal stimulus from the Trump administration.

It will be interesting to see just how much the fiscal stimulus plans contributed to the interest rate forecasts from Fed policy makers in December and whether there is potential for the pace to be faster still, if many didn’t take it into consideration due to the uncertain nature of what it will actually consist of.

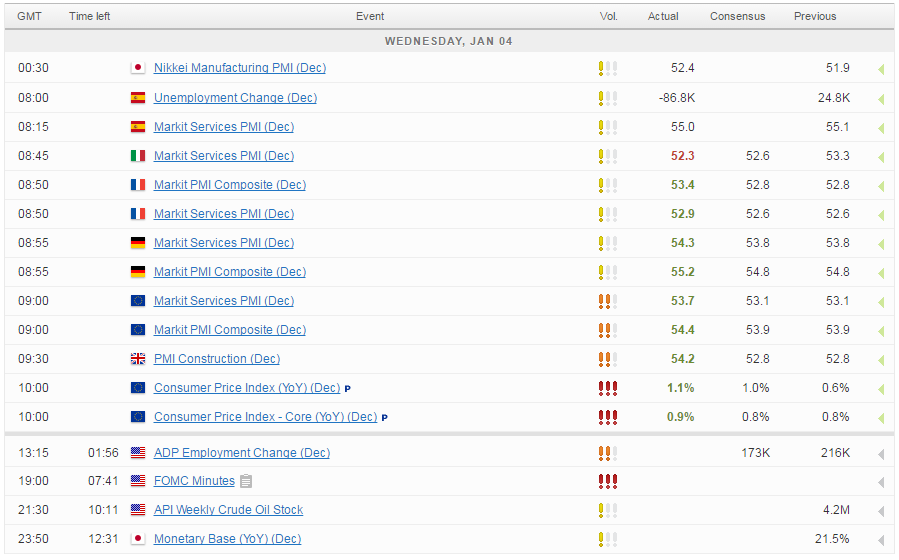

We’ve had a flurry of data from Europe during the morning session but investors appear relatively unmoved by the numbers. The PMIs from the eurozone, Germany and France were broadly positive, with flash numbers having been revised higher for December, although these figures were still lower than those reported in November. Inflation in the region rose at a faster pace than expected, with prices rising by 1.1% and core prices by 0.9%, with oil contributing significantly to sudden increase. The question now is how the ECB responds to the uptick in inflation having already cut its asset purchases in December.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.