US futures are pointing a little higher at the start of what is likely to be a relatively quiet week, as the Dow targets another assault on the psychologically important 20,000 level that has so far eluded it.

The Dow has come close to breaching 20,000 on multiple occasions over the last four days but each time the index has fallen just short. With the index future pushing higher again ahead of the open, I would be surprised if we’re not trading above 20,000 before the end of the year. The Trump rally has stalled a little in recent sessions but so far, I’m seeing few signs that we’re going to see the year out on a negative note.

USD/CAD – Canadian Dollar Edges Higher, Wholesale Sales Next

Of course, in very quiet periods such as this, these things can often be increasingly difficult to predict. Trade is likely to be rather light over the next couple of weeks with the odd sprinkling of data. The stand out event this week will be the Bank of Japan monetary policy decision on Tuesday but even this will likely pass without any noteworthy changes in terms of policy or outlook, although in thin trade we could still see a lot of volatility in yen pairs.

The yen has already been one of bigger movers in trade so far on Monday. The Japanese currency has been under severe pressure over the last couple of months since the BoJ made some tweaks to its bond buying program that has made a big difference at a time when yields elsewhere are on the rise. With the Fed having raised rates and updated its outlook, the ECB cut bond buying but extended the deadline and the BoE in wait and see mode, we could see the yen pare some of these substantial losses in the coming weeks.

Dollar Bruised, but not Battered Just Yet

Oil is also on the rise again today, having come off its post-cut highs in the first half of last week. We saw a decent rise in Brent and WTI on Friday but already today it seems both are running into a little resistance. A failure to break through $52.50 in WTI would make $50 a very interesting level to the downside, a break of which could trigger a move back towards $45.50 in the coming weeks.

OANDA fxTrade Advanced Charting Platform

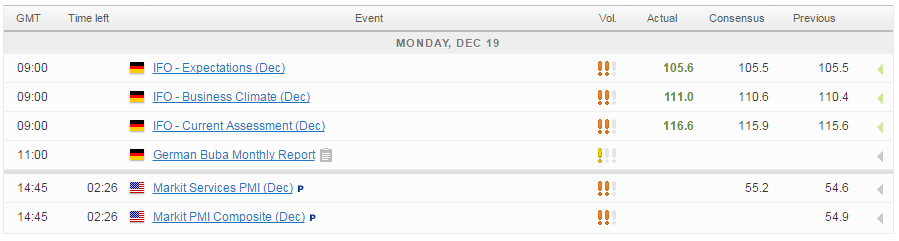

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.