US futures are pointing a little higher ahead of the open on Thursday, as traders continue to digest the Fed announcement on Wednesday and look ahead to some economic data being released throughout the session.

The Fed’s decision to raise interest rates for only the second time in a decade on Wednesday came as a shock to no one, with markets having almost entirely priced the decision in prior to the event. What did catch traders off guard was the number of rate hikes the Fed is forecasting for next year which would suggest markets are still a little behind the curve.

USD/JPY – Fed Hike Propels Dollar Past 118 Yen

Unlike last year though, rather than brush aside the Fed’s forecasts, markets appear to have fallen broadly in line although we’re still marginally short of the third hike being priced in.

Source – CME Group FedWatch Tool

Perhaps the Fed’s forecasts carry more credibility with investors this year given the much tighter labour markets and the fiscal stimulus package set to be announced by President-elect Donald Trump, which many policy makers haven’t factored into their forecasts but would likely prove inflationary.

What is more important though is that, despite the Fed signalling a desire to raise interest rates at a faster pace, there was no panic in the markets which shows the level of confidence investors have in the economy to handle it. Rate hikes are finally seen as a positive once again rather than something that’s going to kill any rallies.

Dot-Plot Blindness has Dollar Bears Bailing

We saw minor losses in equity markets as the dollar strengthened but already we’ve seen futures in the green. The Dow continues to flirt with the idea of breaking above 20,000 but has so far fallen short with profit taking possibly to blame. With traders looking undeterred by the Fed’s forecasts, it could only be a matter of time before that psychological hurdle is cleared and markets continue their relentless run higher.

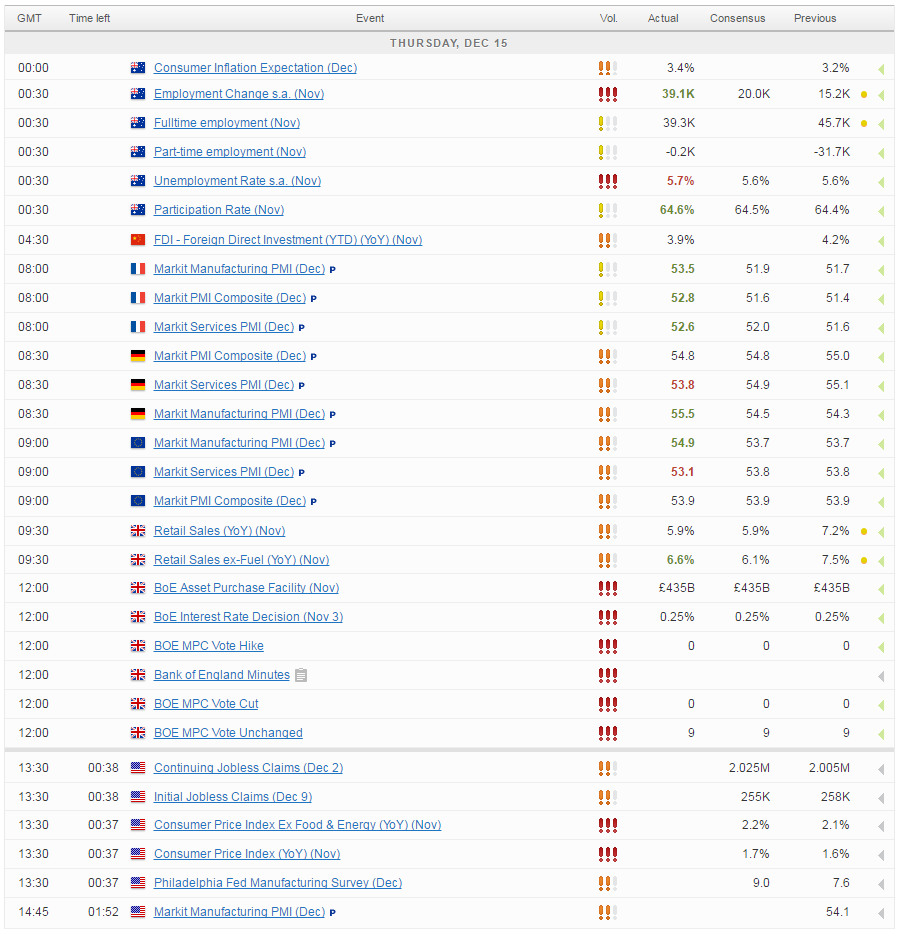

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.