A quiet weekend of news has seen the USD finally see some profit taking and even some whispers of “a meaningful technical correction.” However, before we get too carried away, I thought it would be interesting to see just how much of a technical correction we would need now to put a hole under the USD’s waterline.

I have been quite vocal about a couple of things lately. One, that this entire move has mostly been predicated on the hope of Trump-flation when in fact he has not announced any policy or even appointed a cabinet yet. Two, that Quantitative Easing and ZIRP had reached its sell-by date in the United States a few years ago and that the world was well due the harsh lesson that the real cost of capital is not zero percent and is not bottomless in its quantity.

These two points are a bit at odds with each other I will agree. I justify by saying that Mr. Trump’s election gave the USD and US Yields an adrenalin boost that was going to happen as the Fed finally got its act together in December anyway. The scale of the moves in the USD and yields has certainly surprised me as it has most. Perhaps even more surprising to me is that US equities continue to make new highs as yields explode higher. This is not what Economic Professor said should happen.

This leads back to Monday’s session in Asia. You know it is a quiet news day when everyone’s analysis is full of opinion on the effect on the Euro of the Italian referendum on December 4th. All of a sudden we are seeing polls and predictions and I have a sense of deja vue when I see the word polls and 2016 in one sentence. What is more interesting is to see the scale of the US moves and just have much of a “correction” will now be needed to make the bulls get really nervous. Looking at the weekly charts for a big picture we see….

EUR/USD

Having flirted with 1.0550 Euro’s pullback to 1.0640 still has a long way to go to challenge resistance at 1.0825. Support lies at 1.0560 and interestingly the weekly RSI is not oversold. Political storm clouds aplenty gather for Europe in 2017 but this is a story for another day.

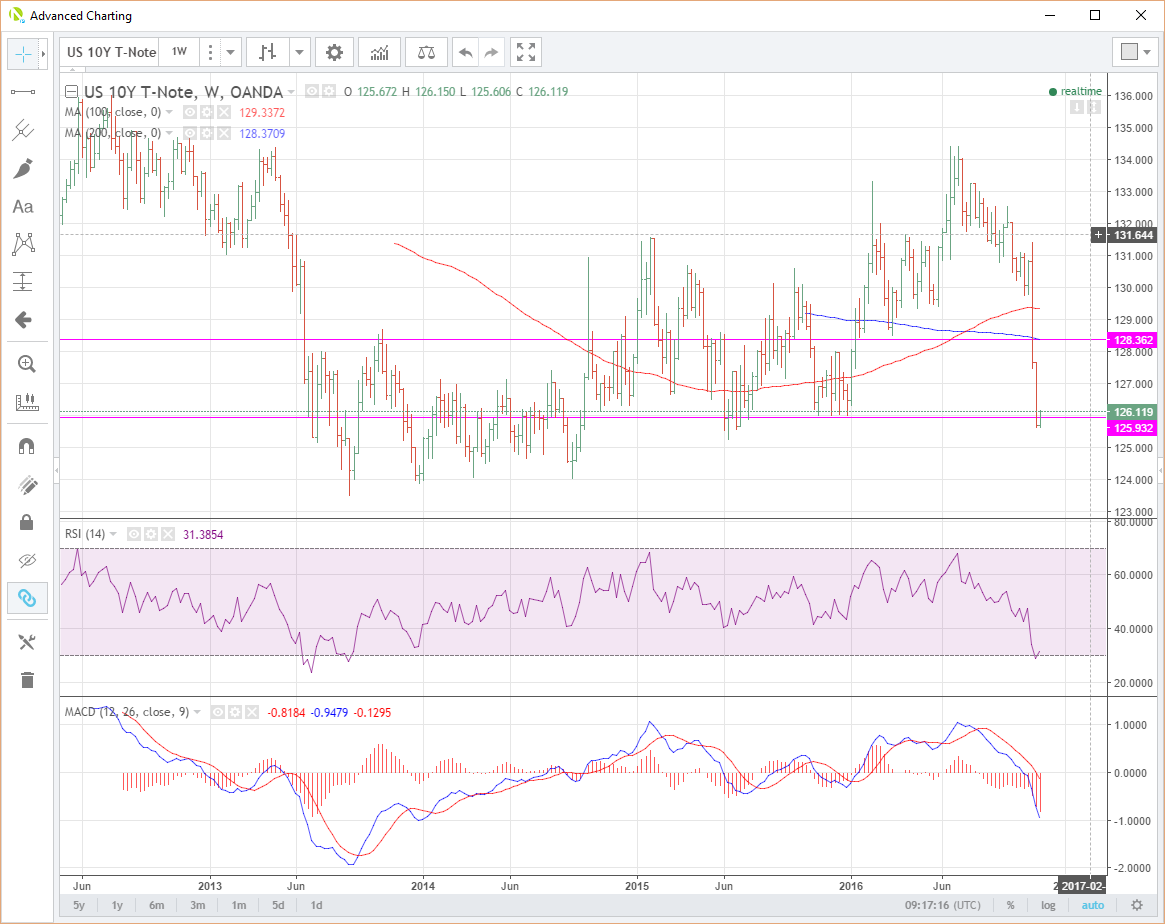

US 10 Year Bonds

A truly spectacular move as the market prices in a couple of years of fiscal inflation and Fed hikes into two weeks! The correction today has seen the 10-year move above weekly resistance at 125.93. However, the real resistance is quite a long way above at 128.362. This is a series of weekly lows and the 200-week moving average. The RSI has bounced slightly from oversold but the MACD still points solidly down so no divergence.

AUD/USD

The proxy for commodities and Asian emerging markets has not fared well with the USD rally. Weekly support lies around 0.7260 with resistance far away at 0.7485 the 100-week moving average and then the trendline break at 0.7600.

Gold

Has managed an anaemic rally to 1220 today having tested 1205 Friday. Support lies here at 1208 the 100-week moving average and then 1199 a multiple weekly low. The scale of Golds fall from grace is easy to see though with strong resistance at 1267. This is the trendline break and also the 200-week moving average.The RSI remains in neutral ground and the MACD down.

I could go on. What I am trying to illustrate is the power of the USD move. I am not suggesting that there will not be an aggressive USD correction on the way. Particularly as it will be a short trading week for the United States. Thursday being Thanksgiving Day and an extinction level event for turkeys. More that from a longer-term technical perspective, traders should keep an eye on the big picture levels should the week get “noisy.”

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.