It’s been a mixed start to trading on Monday, with some of the main market drivers in recent weeks appearing to fizzle out as traders look to lock in some profits on what is likely to be one of the quieter weeks.

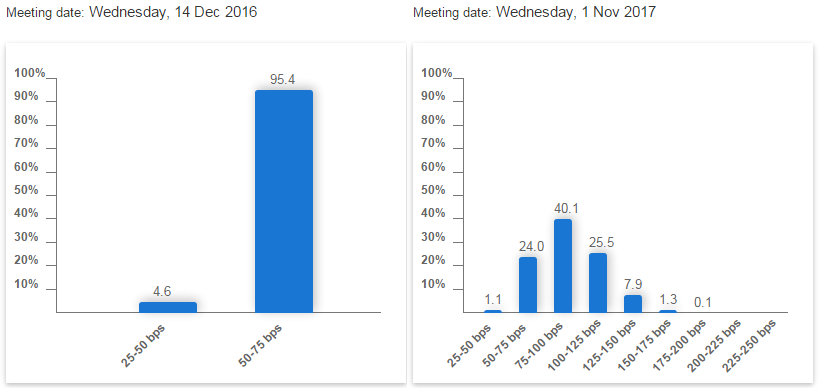

The dollar’s recent surge, triggered by Donald Trump’s election victory and rising rate hike expectations that followed, appears to have cooled off a little. Markets are now pricing in a 95% chance of a rate hike next month so it’s logical that were seeing some cashing in. While this may prompt some dollar weakness in the short term, I still think rate expectations beyond December are too cautious so the greenback is likely to remain well supported.

Source – CME Group FedWatch Tool

USD/JPY – Dollar Flirts With 111 as Yen Under Pressure

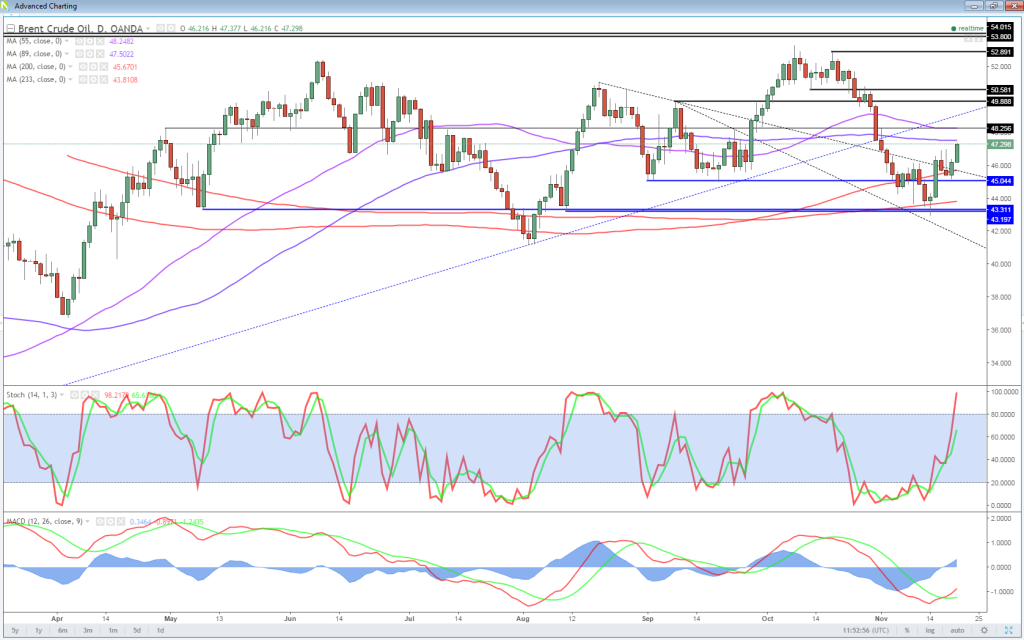

Commodities appear to be benefiting as the dollar comes off its highs, particularly oil which has the added boost of slightly higher hopes that OPEC can reach an agreement on the details of an output cut next week. The initial deal had been thrown into doubt by the unwillingness of certain members to take part in the cut but it would appear people close to the talks remain confident. Vladimir Putin appears to be one of those that has high hopes of a deal being done which would pave the way for Russia to take similar steps. A firm deal next week could see oil spike higher as it’s currently well below the levels it reached in the weeks after the initial deal was agreed in Algiers.

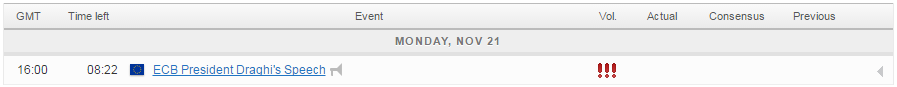

OANDA fxTrade Advanced Charting Platform

The fact that it’s Thanksgiving week and we have few notable economic events should mean it’s likely to be one of the quieter weeks in the markets. That said Wednesday could be quite eventful, with the November FOMC minutes being released, the UK’s first post-Brexit plans from the new Chancellor being announced and a host of PMI numbers due out. Today we’ll hear from ECB President Mario Draghi who may be pushed on what we should expect following next month’s meeting, with the accounts from the last indicating that an update on the QE program will agreed.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.