US futures are pointing lower on Friday, tracking similar moves in Europe where indices have spent the week dipping between gains and losses to find themselves broadly where they started.

It’s been a bit of a nothing week for equity markets in Europe, with the initial response to Trump’s victory appearing to have worn off and investors possibly looking ahead to the remaining risk events this year, being the ECB and Fed meetings in December and the Italian referendum. The Italian market is one area where we have seen some significant downside this week as we look ahead to the very real possibility that political instability adds to financial uncertainty that has held back the Italian economy for years. The FTSE MIB is currently trading around 16,200, an area that has offered support on a number of occasions over the last few months, with the next major level below here coming around 16,000. The Spanish IBEX is also suffering a minor backlash this morning to trade around its own recent lows around 8,550 with the next support appearing around 8,400.

The US dollar is on the rise again and markets continue to price in a more active Federal Reserve in the coming years, starting with a likely rate hike next month which is now more than 90% priced in by the markets. The yield on the US 10-year Treasury is now around the same level it was this time last year when the Fed was preparing its first hike in almost a decade and about to forecast four more this year, which didn’t exactly go to plan. With Donald Trump planning an ambitious spending package once in the White House, we could well see something closer to that next year, although I would still expect fewer, which means the market still has some catching up to do.

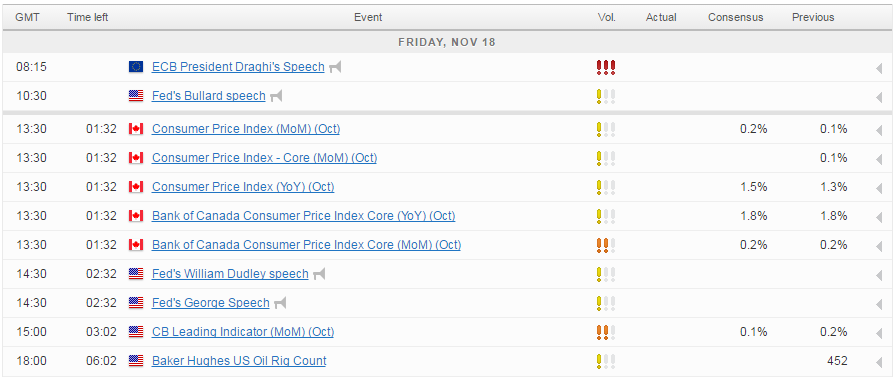

With that in mind, it will be interesting to see what Fed officials have to say ahead of the December meeting. We heard from Chair Janet Yellen on Thursday who hinted at a rate hike in the near future, which many took to suggest December. The comments from other officials, including James Bullard who is due to speak again today, were much clearer, suggesting that he would be surprised if they didn’t hike in December. We’ll also hear from five other Fed officials today including William Dudley, Charles Evans, Esther George, Robert Kaplan and Jerome Powell which should ensure the dollar and Treasuries remain lively.

USD/CAD – Canadian Dollar Steady Ahead of Canadian CPI Data

Commodities are feeling the pressure of the stronger dollar and appear to have taken another turn over the last few days. Gold is closing in on $1,200 which is the next notable level of support. The fundamentals don’t exactly offer much support for Gold which may suggest that it will struggle to find much support around $1,200 on this occasion. Next notable support below here could be found around $1,172 which is the 61.8% retracement of the move from last December’s lows to this year’s highs. It’s also a prior level of support and resistance.

OANDA fxTrade Advanced Charting Platform

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.