We’re seeing the calm before the storm in financial markets on Tuesday as the build up to the US election gets underway prompting extreme caution among traders.

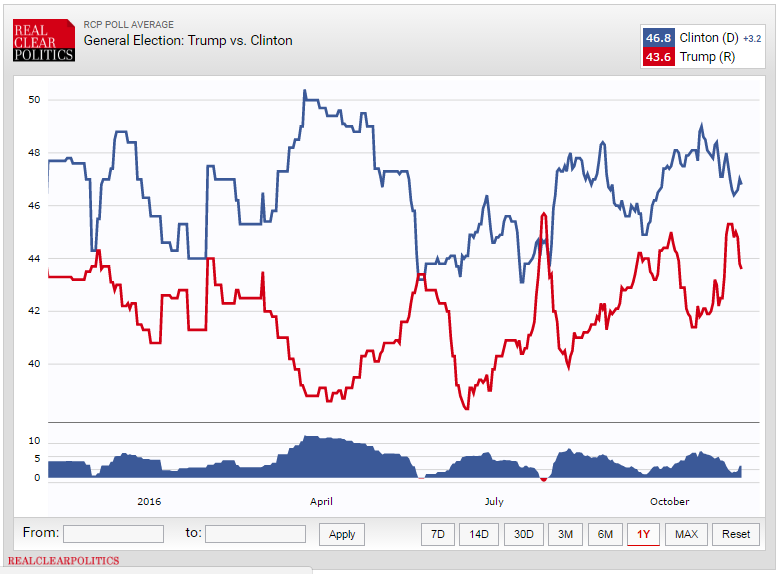

We saw plenty of risk appetite on Monday as traders unwound the previous week’s risk-off positions and once again positioned for a comfortable Clinton victory. The only issue now is that many of the polls don’t necessarily suggest it’s going to be as comfortable as the markets would have us believe which potentially leaves them very vulnerable to a surprise Trump victory. We don’t have to look back very far to see what that can do to the markets.

Source – Real Clear Politics Poll Average

The Trump hedge continues to be relatively well supported though, with Gold remaining above $1,280. In the event of a victory for the Republican candidate, we could see some substantial gains overnight with a move towards $1,350-$1,400 being plausible given the risk-off environment that would likely follow and the impact that such a result could have on Fed policy, with a rate hike in December looking far less likely.

If Brexit was anything to go by we could see plenty of volatility in the markets as the results pour out, particularly if Trump takes one of the major swing states early in the night and sends the market into a frenzy. A number of currencies will be vulnerable to tonight’s vote, even beyond the US dollar and the peso, which appear most exposed. The safe havens, most notably the yen and the Swiss franc, could appreciate considerably in the event of a Trump victory which may force their central banks to respond quite rapidly.

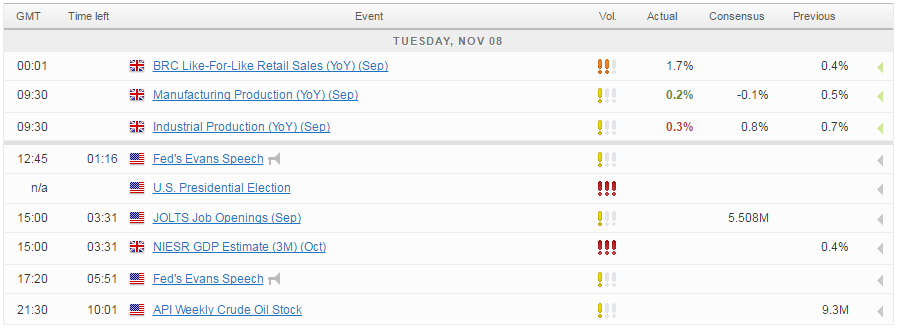

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.