It’s been a slow start to the trading week, as a lack of news flow in Europe and Asia, combined with bank holiday’s in Japan, Canada and the US hit trading volumes and switch attentions to big events later in the week.

The most notable of these comes on Wednesday with the release of the FOMC minutes from the meeting in September. While investors finally appear to be coming in line with the Fed in pricing in a rate hike in December, having correctly positioned against the central bank throughout the year, this belief remains extremely fragile and it won’t take much for expectations to be pushed back to 2017 once again.

EUR/USD – Euro Edges Lower, US Markets Closed for Holiday

The jobs report on Friday did little to shift expectations being weaker than expected but falling in line with what the Fed deems acceptable job creation. With three members dissenting at the last meeting, the most interesting thing in the minutes will be how close other members are to joining them. In particular, Chair Janet Yellen and some of her closest allies will be focused on, as they effectively hold the swing vote that will ultimately determine whether we get a rate hike this year or not.

Corporate earnings season also gets underway this week and in the absence of significant growth in the first half of the year, investors will want evidence that the economy is growing and has ongoing growth potential, beyond job creating and low unemployment. We kick off unofficially tomorrow with Alcoa’s earnings but may need to wait until the end of the week for some of the bigger names to start reporting.

Week Ahead Pound Flash Crash Eclipses NFP

As for today, focus will likely remain on some of the big moves that we saw last week, including the flash crash and sharp depreciation in the pound, dollar gains, the corresponding drop in Gold and the four month highs in oil. While moves so far today have been more tame, as we’ve seen so often in the past, the US open can spark markets back to life.

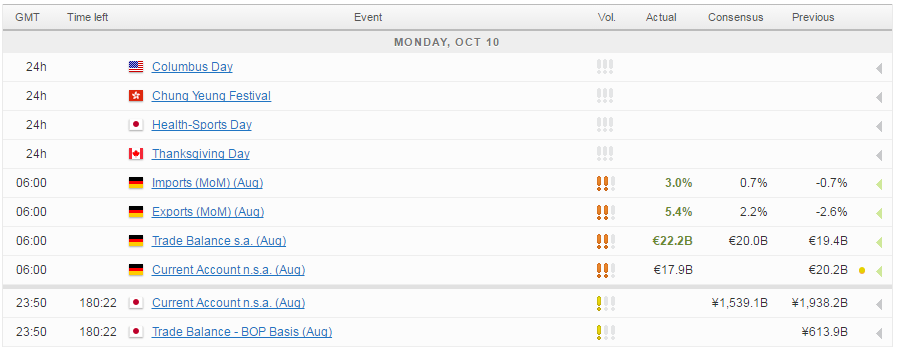

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.