European equity markets are expected to open relatively flat following a quiet session in Asia overnight, with investors remaining focused on the European banking woes and Brexit, while the RBAs slightly dovish stance weighed a little on the Australian dollar.

I think traders are seeing a number of reasons to be a little cautious this week. One of the obvious reasons for this is that we’ll get the US jobs report on Friday which often weighs on risk appetite, albeit not always. Add to this the ongoing drama around Deutsche Bank and whether the eventual fine will give us more reason to be worried about the banking sector or offer a little reprieve.

USD/CAD Canadian Dollar Rises as Oil Rallies Higher

The sell-off in the pound on Monday was a clear sign of an anxious market as Theresa May’s declaration that article 50 would be triggered by the end of March next year was not exactly new information but the confirmation of this was enough to trigger more selling in the pound. With it now trading back at the post-Brexit lows, it will be interesting to see whether it has the legs to make new lows and possibly spark a move back towards 1.25.

Today’s construction PMI may be that catalyst, although we did see a strong rebound in the number last month, albeit not enough of one to drag it out of contraction territory where it has lingered since the vote.

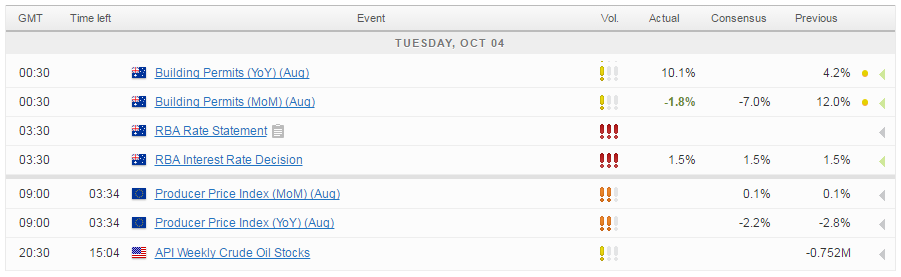

The RBA was one of the few notable events of the Asian session overnight and while the central bank may be under the new leadership of Governor Philip Lowe, the bulk of the message was unchanged. The more comfortable view of the housing market from the RBA was the biggest surprise overnight given that this has been one of the key factors stopping them from cutting rates faster in the past. With the central bank once again warning that an appreciating exchange rate could complicate any economic adjustment, the message was seen to have a more dovish tilt, although no near term rate cuts look likely at this stage.

OANDA MP – GBP Slides on May Comments (Video)

The economic calendar is looking a little light today although one thing that does stand out is the speeches from Fed policy makers Jeffrey Lacker and Charles Evans. While neither of these are voting members of the FOMC this year, it will still be interesting to get their view on how the economy has performed as of late and whether we should still expect a hike this year, with markets now pricing in a 62% chance of one by December.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.