Financial markets are expected to remain relatively subdued on Tuesday as tomorrow’s Bank of Japan and Federal Reserve meetings push traders to the sidelines in anticipation of some very volatile markets.

As is often the case ahead of a major central bank event, traders can get a little nervous and sit on the fence. The fact that we have two on the same day is only exacerbating the problem. While there is scope for intraday volatility I don’t expect to see many major swings ahead of the BoJ decision tomorrow.

Pound Woes Continue, Focus on Fed and BoJ

Commodity markets have been a good source of volatility over the last week, particularly oil which has come off again after last weeks’ rally. It is coming under pressure again today although it is struggling to gather any real momentum, with $45.50-46 providing support in Brent crude and $43 in WTI. The API inventory data could be the catalyst to take it below these levels when it’s released later in the session, although it is worth noting that the last two weeks have reported a build in inventories. The suggestion by Venezuelan oil minister Eulogio Del Pino that supply needs to drop by around 10% to match demand did appear to weigh on oil earlier in the session, although this wasn’t quite enough to see oil through this key support zone.

US housing data is also being released on Tuesday which may have provided a spark for the markets but for the Fed stealing the spotlight. The data has more than likely come too late to impact the outcome of the meeting, not to mention the fact that it isn’t something that policy makers have flagged as being particularly influential in their decision making. Still, it could spark some life into the dollar, which is currently trading marginally lower on the session.

USD/CAD – Canadian Dollar Edges Higher, Fed Announcement Looms

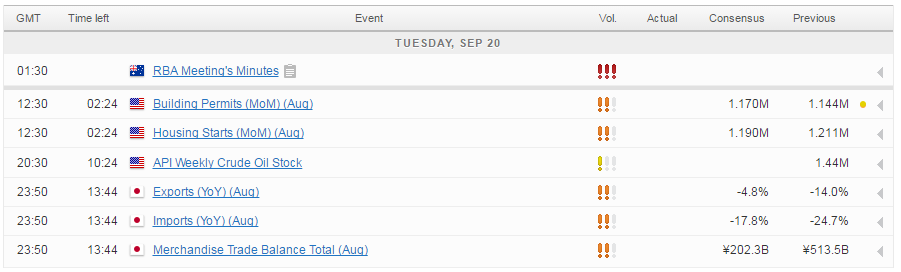

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.