European equity markets got off to a decent start on Tuesday, taking a lead from the rebound in the US on Monday which came as Lael Brainard suggested that the Fed should avoid removing accommodation too quickly.

Brainard’s comments echoed those of fellow permanent voter on the FOMC Daniel Tarullo who also claimed in recent days that he’d like to see further evidence that inflation will continue to go up and be sustained around the target. While consensus does generally appear to be building for a rate hike, it once again looks very unlikely to happen in September with two Governors yet to be convinced it is warranted.

The implied probability of a rate hike in September has now fallen from 24% to 15% which has helped spur stock markets higher, almost entirely reversing Friday’s declines in the US and helping offset the disappointment of the ECB in Europe.

Source – CME Group FedWatch Tool

With the Fed having now entered the blackout period ahead of the meeting next week, attention is likely to shift back to the economic data and other events this week. Of course, next week’s meeting will remain on people’s minds over the next seven days.

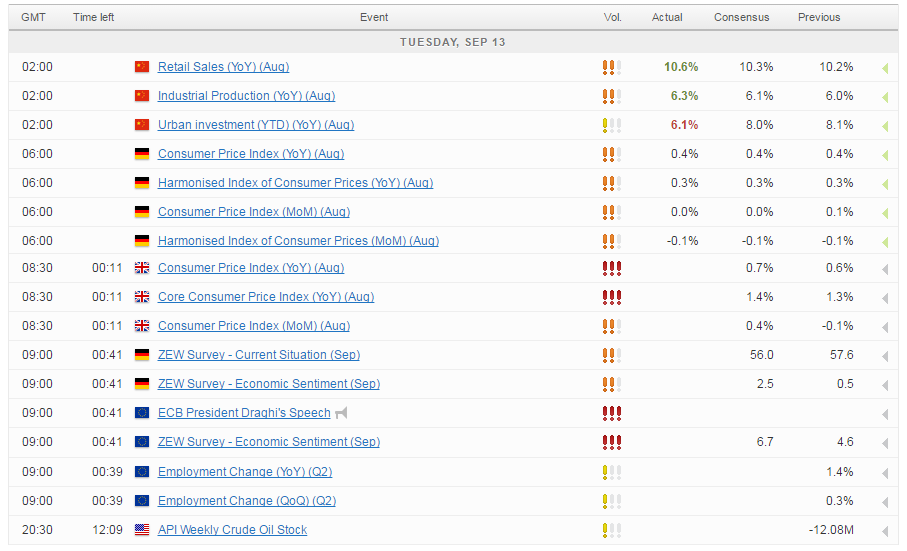

In the meantime, focus will shift back to Europe with UK inflation and eurozone economic sentiment data being released. Inflation in the UK is already on the rise and is expected to continue higher in the coming months as input costs from abroad continue to filter through to the consumer and threaten to weigh on spending. We’re expecting both the CPI and core CPI figures to edge higher to 0.7% and 1.4% from 0.6% and 1.3%, respectively for August.

Economic sentiment in Germany and the eurozone is expected to stage another small recovery in September having suffered considerably in the immediate aftermath of the Brexit vote. We’ve seen little evidence yet of Brexit having any significant impact on the euro area and yet investors and analysts clearly remain sceptical, with the numbers remaining well below the June levels.

OANDA MP – Markets Rattled by Fed Remarks (Video)

We’ll also hear from Mario Draghi this morning when he speaks at the 2016 Alcide De Gasperi Award ceremony in Trento. The disappointment of Thursday is still fresh in the memory of investors wanting to know whether and when the ECB will respond to the low inflation and growth environment, both of which suffered downgrades to forecasts in the most recent economic projections. Draghi is unlikely to provide any details though with the ECBs priority appearing to be the challenged faces with the current program and the availability of qualifying instruments.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.