European equity markets are deep in the red on Monday, catching up on moves in the US on Friday and Asia overnight as investors come more around the possibility of a rate hike this year, possibly even as early as this month, although that remains a long shot.

We heard from three Fed policy makers on Friday, two of which – Daniel Tarullo and Eric Rosengren – are voting members on the FOMC this year and the message that investors took from them is that a hike is much more likely than is currently priced in. I don’t think the comments themselves were particularly hawkish or indicate that a hike is nailed on but perhaps the cumulative effect of the number of policy makers now hinting at one this year is finally getting the message through. The mixed message has often been a problem for the Fed in the past.

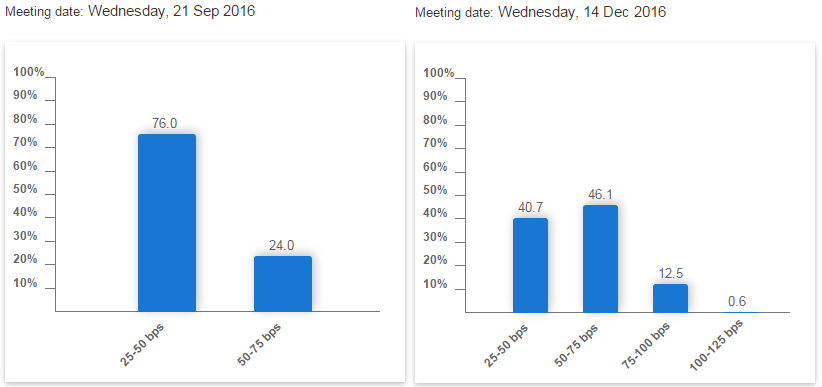

Source – CME Group FedWatch Tool

EUR/USD – Euro Subdued as Markets Search for Cues

Should we continue to get a consistent hawkish message from policy makers ahead of the blackout period, we could see the implied probability of a hike in September ramp up considerably which based on the moves since Friday, would be bad news for equity markets. US futures are pointing to another negative open on Wall Street at the start of the week which could see technical support in the S&P 500 – around 2,110-2,120 – and Dow 30 – around 18,000 – come under pressure. A break below here could be quite bearish for the indices.

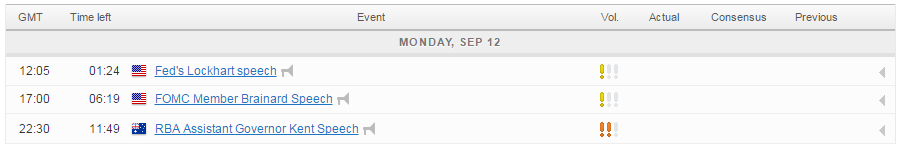

The catalyst for this could once again come from Fed policy makers, with Lael Brainard, Neel Kashkari and Dennis Lockhart all scheduled to speak. Brainard’s comments will be of particular interest as she is the only voter on the FOMC this year. Further hawkish commentary and any indication that a rate hike is likely could trigger another wave of repricing for September and December, which in turn could see the dollar and Treasury yields on the rise again and equities coming under pressure. It’s also worth noting that Brainard is among the more dovish members of the Fed.

US Rate Hike Jitters Grip Markets

Commodities are also sensitive to changing rate hike expectations and have been quite volatile at the start of the week, with Gold, Silver and Oil down on the day. A stronger dollar which often comes with an increasing rate hike probability is bearish for commodities, particularly Gold, as it makes them more expensive to holders of other currencies. Oil is also sensitive but there is also plenty of other factors at play here. Brent and WTI have recovered from the shock of a substantial drawdown in inventories last week and a new “cooperation” between Saudi Arabia and Russia on production. The reversal on Friday suddenly makes them look much more bearish than they looked following the release of the inventory data.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.