US futures are pointing slightly higher on Thursday while in Europe, indices have had a positive start and in many cases are threatening to or have already broken above what has been quite a congested summer trading range.

USD/CAD Canadian Dollar Falls on Oil Tumble and Mixed Economic Data

The FTSE is underperforming in the session driven by a combination of a stronger pound and further downside pressure on commodities. The pound is flying early in the session after the UK manufacturing PMI for August blew away market expectations to record the joint highest monthly improvement in the history of the survey. Not only did the market not expect such a jump, it was barely expecting any improvement at all, just a slight recovery from the knee jerk response in July.

To find the full UK Manufacturing PMI report, click here.

It would appear that the early impact of Brexit is a win win for UK manufacturers. Not only is it still too early in the process for domestic consumers to be feeling the potential pain of Brexit – in fact demand increased, possibly aided by spending abroad suddenly being that much more expensive – but the sharp depreciation of the pound has spurred demand from abroad for UK manufactured goods. While this is great news, it’s still very early in the process and much of the pain caused by Brexit will likely come later on. That said, it is encouraging that the drop in the pound is immediately supporting UK exporters, which will help cushion the blow.

EUR/USD – Euro Ticks Lower as Eurozone, German Manufacturing Meets Expectations

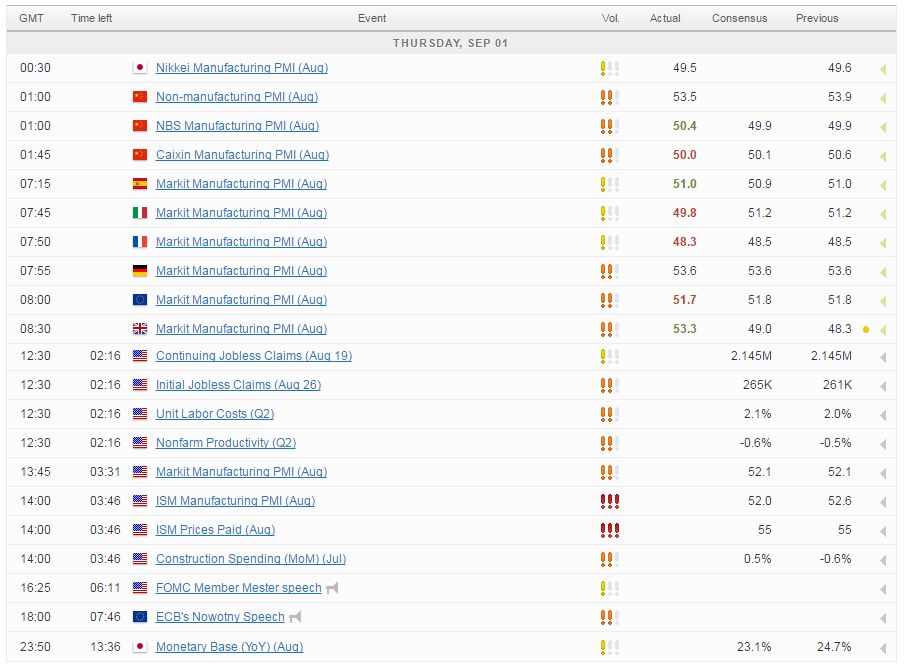

We’ve got plenty more data to come from the US today, although I do think attention will broadly be on tomorrow’s jobs report over today’s releases. Still, the ISM manufacturing PMI often causes a stir in the markets, as could unit labour cost and non-farm productivity figures. Jobless claims and the official manufacturing PMI will also be released but these tend to be lower impact numbers. Ultimately, it’s about what is going to influence the Fed’s decision in three weeks’ time and more so than anything, that will be tomorrow’s jobs report so we shouldn’t expect too much from today’s numbers.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.