US futures are pointing to a slightly higher open on Thursday, tracking similar gains across most of Europe as traders eye the latest economic data and movements in the oil market.

At a time of relatively little news flow, traders are again focused on the movements in oil and whether we’re going to see another move back to the levels seen earlier this year. We saw a decent move lower on Wednesday on the back of the inventory numbers from EIA who reported a third consecutive increase for the first time since the start of May, when the rebalancing in the market was starting to show through.

Source – OANDA fxTrade Platform

OANDA MP – Oil Slides on Inventory Data (Video)

With US oil rigs coming back on line and output declines stabilising at a time when the International Energy Agency is downgrading demand growth forecasts for next year, it’s no surprise that traders are becoming increasingly bearish on oil once again. The meeting between OPEC members next month on the sidelines of the International Energy Forum in Algeria will be key for prices now, although I remain sceptical about whether anything meaningful will come out of it, especially as reports emerge that Saudi Arabia is pumping at record levels and Iran is increasing production at a faster rate than expected.

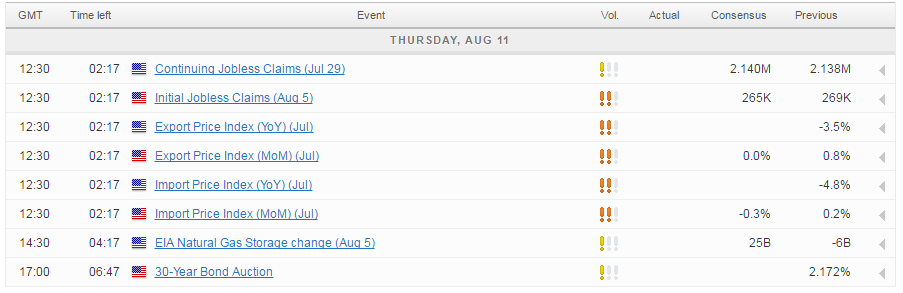

There’s also some economic data being released from the US on Thursday. Jobless claims are expected to have fallen marginally to 265,000 last week, in line with the very low levels that we’ve seen over the last couple of years. Import and export prices data for July will also be released and the former will be of particular interest at a time when inflation remains very subdued. Year on year, import prices have been in negative territory for two years now, something that isn’t expected to change soon and will remain a weight on inflation numbers.

USD/CAD Canadian Dollar Higher Despite Oil Drop

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.