European equity markets opened a little higher on Friday, as investors continue to digest yesterday’s Bank of England decision and look ahead to today’s US jobs report.

Mark Carney gave investors a lot to think about yesterday, not only did he announce a stimulus package that exceeded market expectations, he also left the door wide open to further stimulus this year, and that’s if the economy performs in line with the their expectations. Moreover, the projections for growth, inflation and unemployment clearly indicate that the central bank is very worried about the economic outlook for the UK.

Super Thursday Lives Up To Super Hype

Still, investors appear comforted by the action taken by the BoE and the desire to do a lot more to fight the negative fallout from Brexit. Of course, there is only so much the central bank can do in this situation but should this be accompanied by a growth friendly fiscal package then people may start to feel a little less pessimistic about the post-Brexit UK economy.

With Super Thursday now behind us, attention will now quickly shift to the final key risk event of the week, the US jobs report. The last two months have given two very contrasting views of the labour market in the US, with May delivering only 11,000 new jobs and June 287,000, which has once again driven a number of people to question whether this is the right time for the Fed to be even considering raising rates again.

USD/CAD Canadian Dollar Higher Ahead of US Jobs Report

While these numbers may be indicative of an economy that is failing to gather any real momentum, it is worth considering that even with unemployment now at 4.9%, the economy has added on average more than 170,000 jobs each month since the start of the year and more than 200,000 since the start of last year. Not bad for an economy with near record low interest rates.

Still, investors are more concerned with what we can expect going forward rather than what has happened previously and today’s report could offer important insight into this. Another poor month of job gains may be seen as a sign that the economy is slowing, which coming after two quarters of weak growth will make the job of justifying higher rates that much tougher.

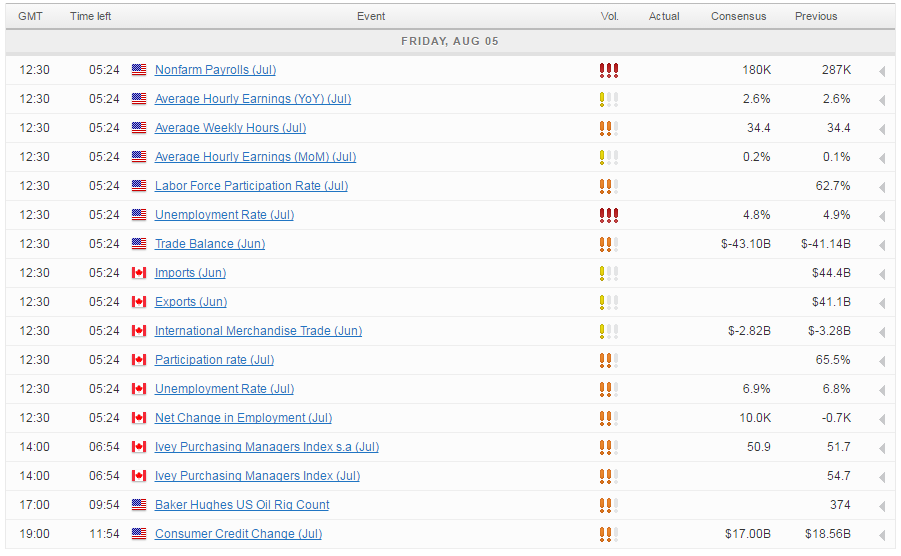

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.