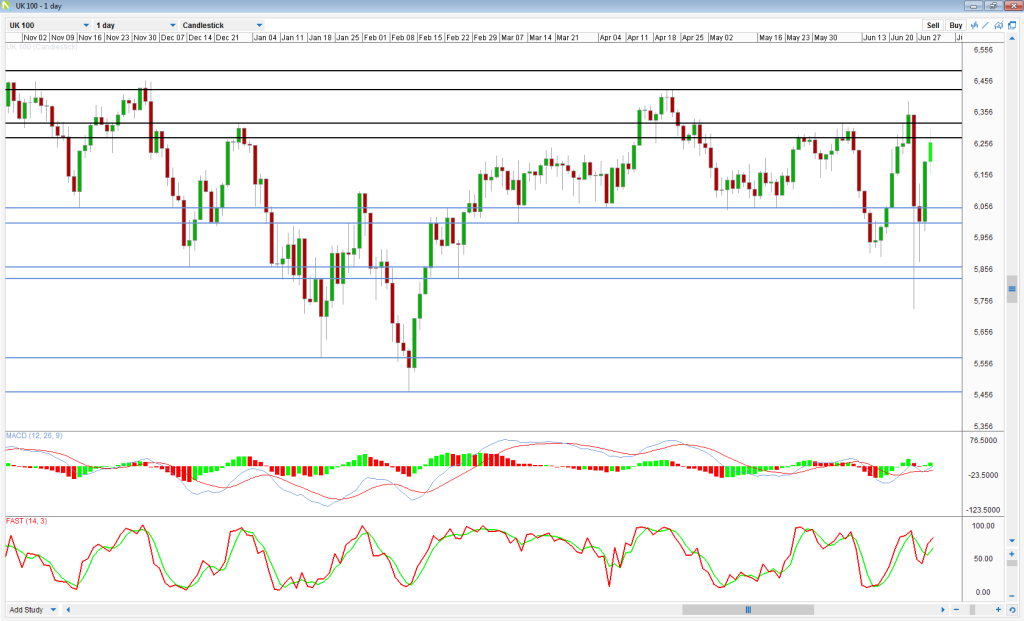

European equity markets are trading in the green for a second day on Wednesday, continuing to pare losses following Friday’s dramatic sell-off. The U.S. is expected to also open higher although these again remain some way off Thursday’ levels. While the initial panic from Brexit appeared to have eased, a huge amount of uncertainty remains which could continue to weigh on sentiment for a while.

The FTSE is now closing in on Thursday’s closing level which is quite extraordinary given Friday’s initial sell-off.

Source – UK100 on OANDA fxTrade Platform

The weakness in the pound will be helping considerably given how much of the FTSE’s profits are generated outside of the U.K.. Unlike the FTSE, the pound has barely recovered and continues to trade near its lows. We could see further downside pressure on the pound in the coming weeks, with the cloud of uncertainty surrounding the U.K. unlikely to ease up.

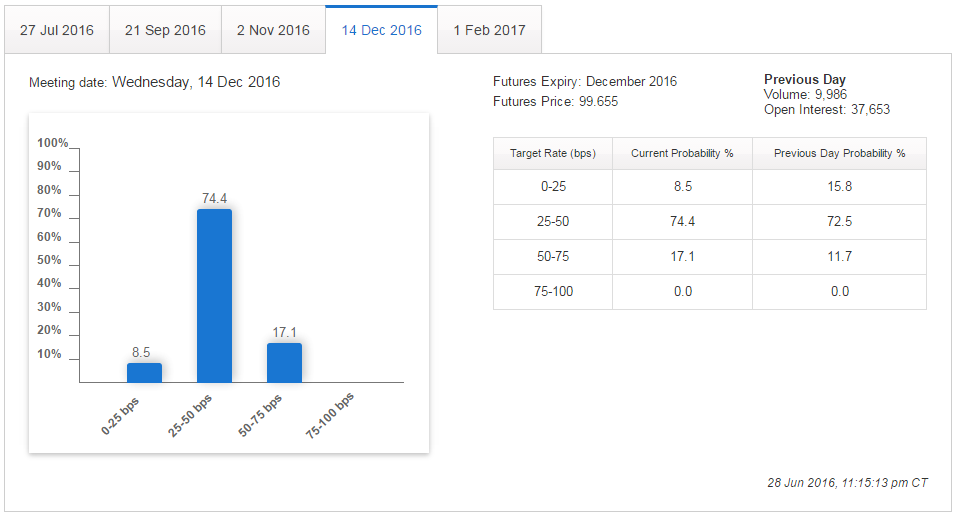

While the U.K. will continue to be a key focus for investors on Wednesday, some attention will shift back to the U.S. where a number of important pieces of data will be released. The chances of a rate hike from the Federal Reserve appear to have slipped considerably since the U.K. referendum, with the uncertainty surrounding the result already being felt in financial markets and possibly flowing through to the global economy. Markets are now pricing in only a 17% chance of a rate hike this year and a higher chance of a cut by November than a hike.

Source – CME Group FedWatch Tool

That said, investors will still be looking to the data for signs that the economy is recovering despite the headwinds that lie ahead. The core PCE price index stands out as the most important release, with it being the Fed’s preferred measure of inflation, and any sign that this is picking up ahead of what could be a challenging period, would be welcomed. The same applies to income and spending figures, although I don’t imagine for the moment at least that they will have any significant impact on people’s views when it comes to interest rates.

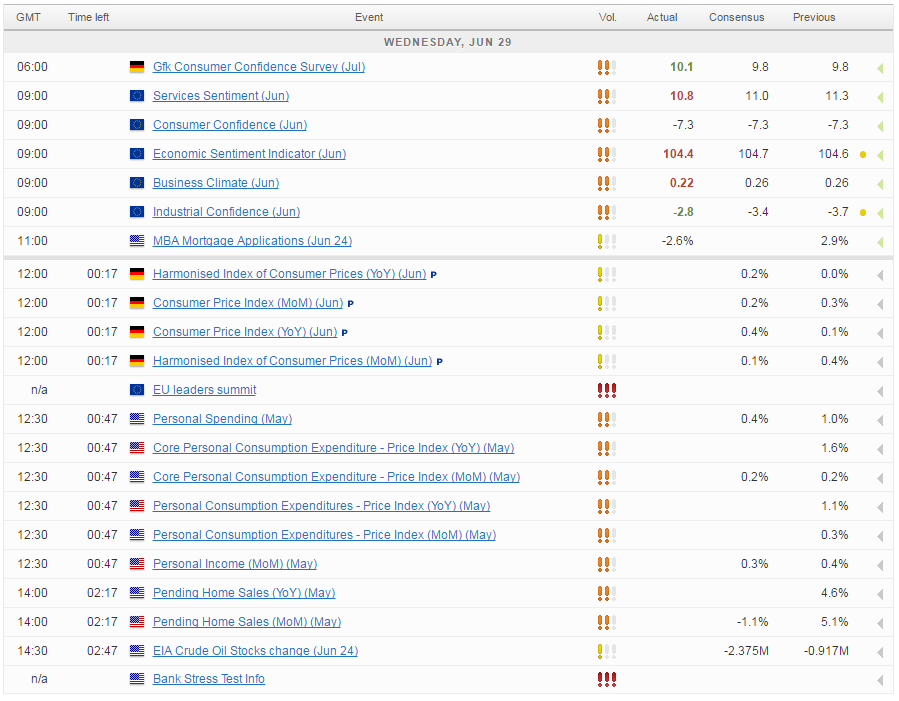

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.