We’re seeing risk aversion in the markets again on Tuesday as support for Brexit in the UK continues to rise ahead of the vote next week.

The betting odds, which during the election and Scottish referendum provided a more accurate reflection of how people actually voted, suggest the gap between leave and remain has closed considerably over the last week. This has happened as the more unreliable polls have suggested the leave campaign has taken the lead and a national newspaper has thrown its support behind Brexit.

It would appear that the leave campaign is going from strength to strength at a time when the remain campaign is running out of ideas. Given that there is still more than a week to go until the vote, David Cameron must be concerned that what appeared to be a massive lead at one stage has slipped considerably and they could now go into the vote next Thursday as underdogs. Cameron may well have underestimated people’s desire to leave the EU when he guaranteed the vote during last year’s election, in what now could turn out to be a political gamble gone wrong.

OANDA MP – Big Two Weeks for the Markets (Video)

One positive thing to come from the last few days is that markets finally appear to be pricing in the real possibility that the UK could vote out. The pound has been in freefall over the last week, a trend that could well continue between now and next Thursday if momentum remains with the leave campaign. At this rate, I wouldn’t be surprised to see the pound trading at 1.35 against the dollar before the vote even takes place, although that would require another massive push by the leave campaign and another poor show from remain. You have to wonder whether remain has one more ace up its sleeve as the same old message is no longer working. Even equity markets are coming under pressure and they have been quite resilient until now.

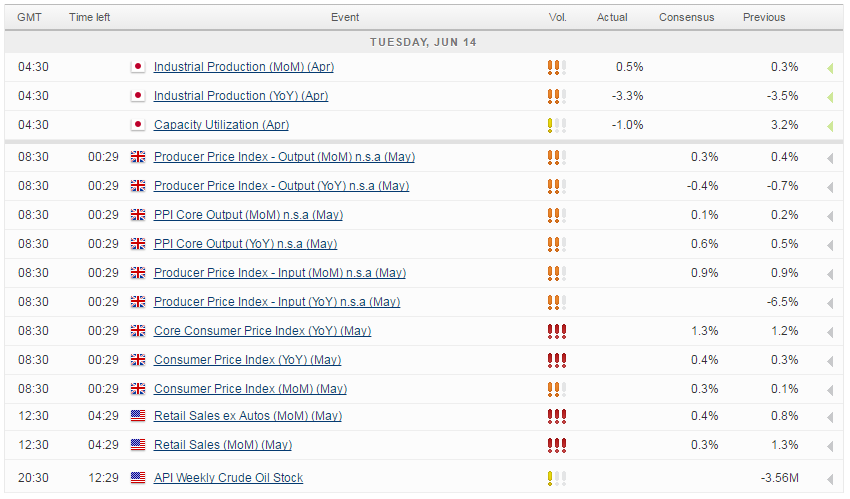

With the UK referendum front and centre of people’s minds, today’s inflation data may not attract the same amount of attention as normal. Should the UK vote to leave, the figure will be far more driven by the currency moves, the terms of leaving and the Bank of England’s response than what’s gone previously. Equally, a vote to stay could be influenced by where the pound stabilises again and whether the economy does in fact rebound in the second half of the year.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.