European equity markets are expected to open relatively mixed on Tuesday following a quiet start to the week as bank holidays in the U.K. and U.S. hit trading volumes.

Fortunately, the week should pick up, particularly towards the back end of the week when we’ll get the latest policy decision from the ECB and the all-important jobs report from the U.S., the last before the June meeting. Federal Reserve officials have repeatedly claimed that a summer rate hike would be a reasonable assumption, a view that was supported as recently as Friday by Chair Janet Yellen, although as always, the decision will be data dependent. I imagine the U.K.’s referendum on E.U. membership will also be an important factor, depending on just how close the polls are come the Fed meeting.

Week Ahead in FX: ECB, OPEC and US Employment to Drive Market

While Friday’s jobs data will be the standout release for the U.S. this week, this afternoon’s income, spending and inflation data is also very important. The core personal consumption expenditure price index is the Fed’s preferred measure of inflation and currently lies just below target at 1.6%. The Fed has made it clear that it expects future increases in the inflation data to be very gradual and yet, should we see it edge higher again today, it would further justify the need for a rate hike this summer.

There’s also plenty of data to come from Europe this morning, most notably the flash CPI figures for May. The euro area is expected to have remained in deflation territory for a fourth consecutive month despite the best efforts of the ECB to lift price pressures with a substantial stimulus package back in March. This obviously takes some time to filter through but another month of deflation shows just how difficult a job the central bank has on its hands. It will be interesting to see what ECB President Mario Draghi will have to say on this on Thursday and whether he anticipates another stimulus splurge in the months ahead.

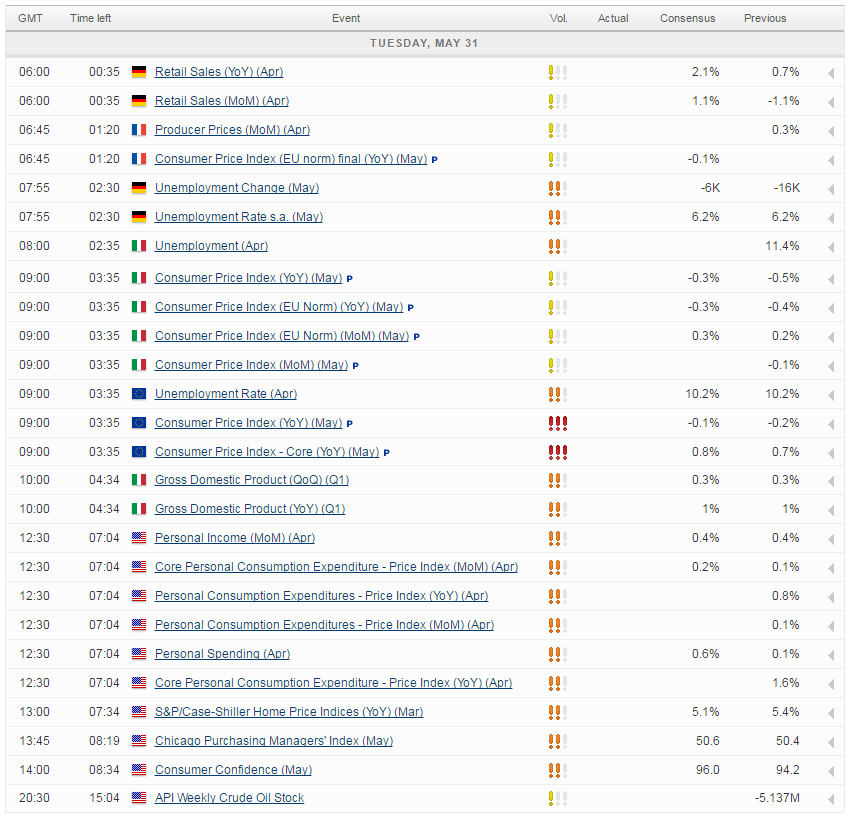

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.