Bank holiday’s throughout Europe may make for light trading on Monday but going forward, things should pick up significantly with a number of key economic events scheduled for this week.

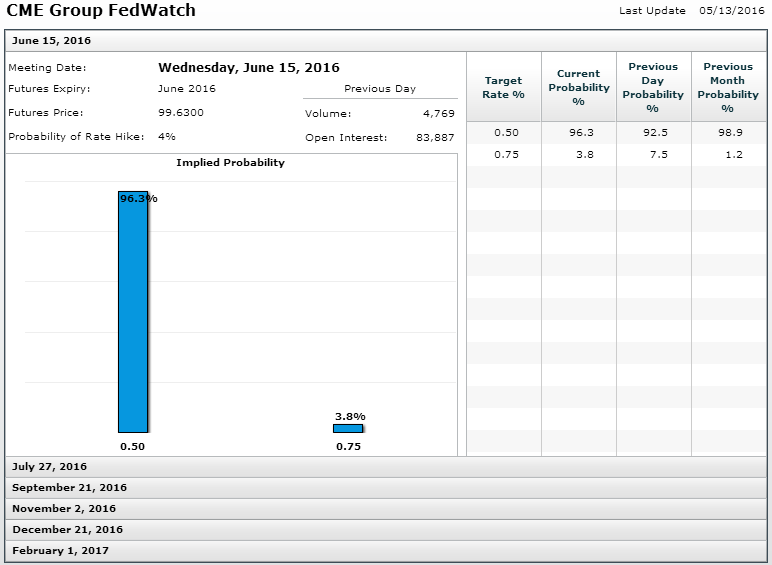

The standout event this week will of course be the release of the FOMC minutes from the April meeting on Wednesday evening, despite the fact that markets remain absolutely convinced that June is not a “live” meeting. An impressive retail sales report on Friday did nothing to convince investors otherwise and in fact, the implied probability of a rate hike based on Fed Funds futures fell from 8% to 4%.

Source – CME Group FedWatch Tool

The minutes should provide more insight into the where exactly the Federal Reserve lies on the tightening process and whether it’s going to put up much of a fight with the markets. We’ve had numerous warnings recently from different Fed officials that June remains on the table and that markets are too pessimistic on the economy and the timing of future hikes and yet, the markets just brush them off. It will be interesting to see how they respond should we get similar tones from the minutes on Wednesday, although it may now be too late to prepare markets for a June hike without creating unwanted instability and volatility.

It’s going to be another important week for the U.K. as the Brexit debate picks up and we get the latest inflation and labour market data. The “Leave” campaign has been relatively slow to get going so far, while a number of external figures have backed the U.K. to remain within the E.U.. Boris Johnson has been a lot more vocal over the last week, since his tenure as London Mayor ended, which could be a sign we’re going to see a lot more fight from the anti-E.U. camp in the coming weeks.

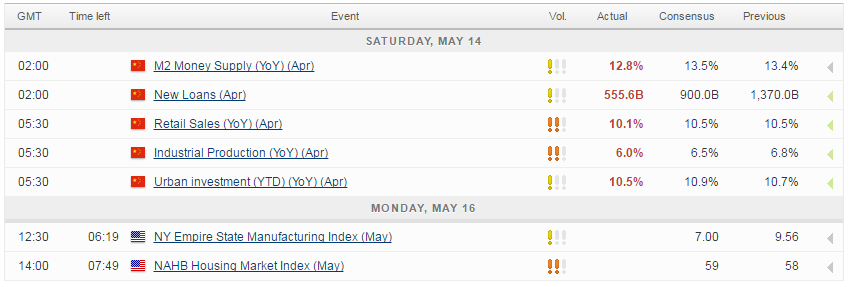

It could be a relatively slow start to the week with Monday being a bank holiday in much of Europe and relatively little data being released. We had a mixed session is Asia overnight as investors overlooked the weaker data from China over the weekend to remain range-bound, moving between positive and negative territory throughout the session.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.