It’s been a week of consolidation for the markets during which there has been periods of volatility and yet most markets are not far from where they opened on Monday.

Given that most of the week has been relatively slow from a news flow perspective, it’s perhaps not surprising that we’ve seen some consolidation, the question now is whether this potentially signals an exhaustion of recent trends or just a break. There is a number of assets that have been on a great run in recent months, oil, Gold, Silver, equities and the yen to name some and perhaps this break signals the need for a new catalyst to trigger the next move or in the absence of it, a temporary topping out.

The rebound in the dollar this month may be one of the reasons why the rally in each of these have run out of steam and given the comments we had from Federal Reserve policy makers on Thursday, the sell-off may be overdone. The most significant of these was Eric Rosengren – one of the more dovish policy makers – who claimed the markets are underestimating the pace of potential rate hikes by the central bank. This is a clear warning shot to the markets that they need to come more in line with the Fed’s forecasts this time round rather than wait for the Fed to line up behind investors, as it has since it raised rates in December.

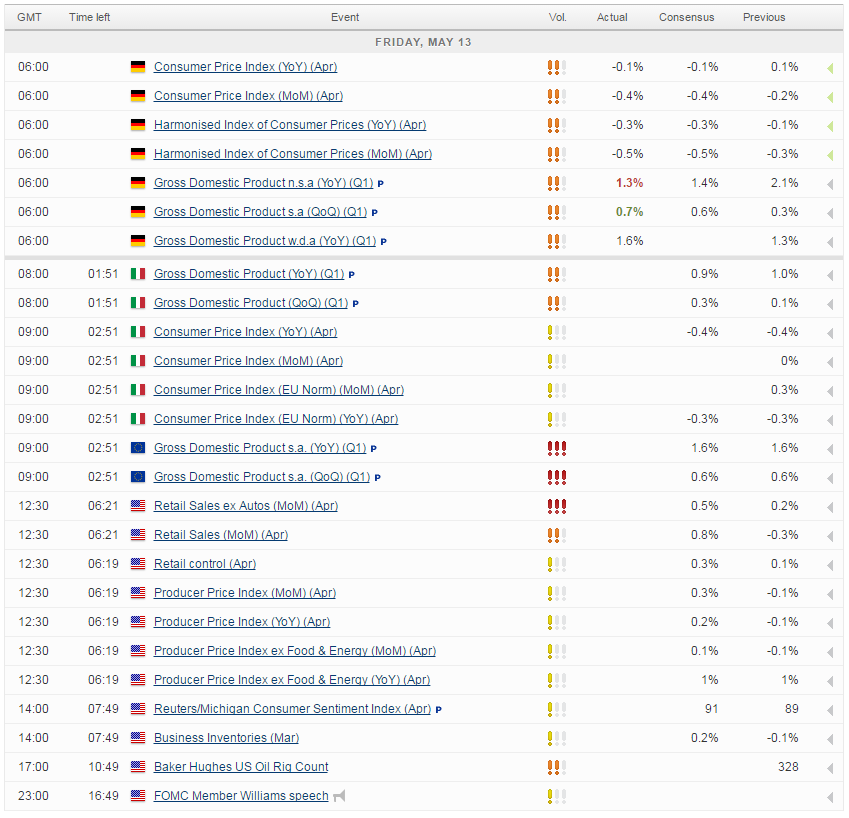

We’ll get another look at the U.S. economy today, this time with a focus on the consumer as we get retail sales data for April and the preliminary UoM consumer sentiment survey for May. The consumer is a hugely important component of the U.S. economy and therefore these numbers are seen as a great barometer of overall economic health and its sustainability.

Consumer spending numbers haven’t exactly blown people away over the last year which may be one of the key reasons why markets just can’t get on board with the need for the Fed to continue raising rates. Prior to this, people looked at consumer sentiment data as being one of the reasons why we could see spending pick up but even this has now come off its highs and the trend has been one of sentiment declining since the start of 2015, not improving.

This morning we’ll get first quarter GDP data from the eurozone, as well as Germany and Italy which will be of interest to investors. The eurozone is seen as growing by 0.6% in the first quarter, 1.6% compared to the same quarter last year, supported by 0.6% quarterly growth in Germany, while Italy is expected to have grown by only 0.3%. These growth figures are far from great but are probably the best we can expect over the next couple of years as the region continues to reform its way to sustainable growth and be held back by its weakest members, slowest implementers and of course now, slowing global trade and growth.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.