Gold has been on the rise again on Wednesday, benefiting from the weaker dollar in today’s session, and coming off yesterday’s which happened to coincide with an interesting level of support.

The yellow metal has been in correction mode so far this month since coming off its highs hit on 2 May – around $1,303.83 – but may be about to continue its ascent having rebounded nicely off a key support level.

This came around $1,256.50 where the 61.8 Fibonacci retracement level – 22 April lows to 2 May highs – crosses with the ascending trend line from 14 January lows.

We initially saw some stabilisation in Gold, coming after quite an aggressive sell-off on Monday but today it appears to have rotated back to the upside, breaking through yesterday’s highs with the next important test coming around $1,287.78 – this week’s high.

While we have seen some decent gains in today’s session, it’s looking unlikely that this will be achieved today. With that in mind, I would like to see the morning star formation completed which would mean it closing more than two thirds of the way into Monday’s candle, so above $1,279.78.

This would be quite a bullish signal and may suggest we’re going to see another push to break above $1,307.78, having failed at the last time of asking. Above here it could run into further resistance around $1,319.50-1,325.50.

Alternatively, if we see more downside pressure, it could suggest a broader correction of this year’s rally is to come. A break of the trend line would be the first indication of such a move, with support below here coming around $1,224-1,227.50.

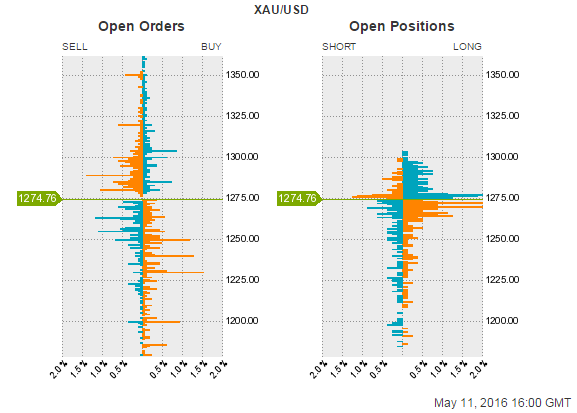

The position ratios and order book tools, and many others, can be found in OANDA Forex Labs.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.