European equity markets are expected to open higher on Tuesday following a relatively quiet session in Asia, where most markets have been moving between small gains and losses throughout the session.

The one bright spot has been the Nikkei which is up around 2%, boosted by weakness in the yen at the start of the week. The long yen trade has started to look quite crowded recently and has shown signs of topping. It now appears to have entered into correction mode, at least for now, helped by a similar correction in the dollar which appears to have bottomed following a significant period of weakness this year.

The rebound in the dollar has taken the edge of commodities over the last couple of weeks, even oil markets which could quite easily have been spurred higher by the raging fires in the Canadian oil sands region. While the damage has been played down overnight, more than one million barrels per day – almost one third of Canadian production – is reportedly offline and there is no way of knowing at this stage when that will return.

This could have led oil prices higher but the stronger dollar possibly combined with near-record OPEC output is currently keeping a lid on any moves higher and it looks as though we could see oil edge a little lower. WTI has come off its highs in recent days and a move below last week’s lows this morning could trigger a move back towards $40.

Chinese inflation data overnight was broadly in line with expectations although there was some good news from the PPI release, which narrowed to -3.4%. While this will continue to apply deflationary pressure, it is an improvement from March’s 4.3% decline and suggests the negative price pressures from the drop in commodities is beginning to abate.

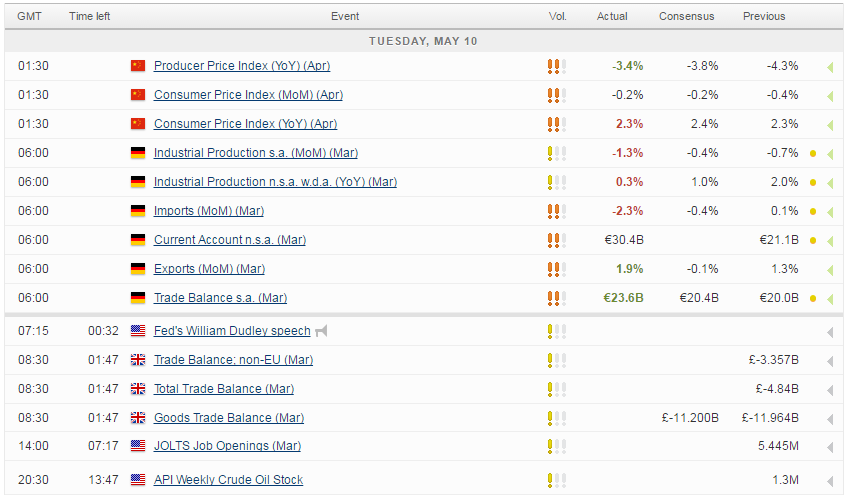

Still to come today we’ll get the latest trade balance data from the U.K. followed by JOLTS job openings from the U.S. This will be followed this evening by the API weekly crude oil stocks number, which is expected to show another small build and could keep the pressure on oil prices.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.