U.S. futures are pointing to a negative open on Thursday, tracking losses in Europe and Asia overnight, as investors weigh up the slightly hawkish Federal Reserve statement on Wednesday and look ahead to the advanced first quarter GDP data.

While the Fed may not have made any direct reference to the June meeting in its statement on Wednesday, it would appear based on what it did say – and didn’t for that matter – that June remains live and therefore the data between now and then could be key. The Fed has repeatedly reminded U.S. that the timing of the next hike remains data dependent but clearly there have been other factors at play which have forced it to reconsider its position.

With markets having stabilized considerably since January and Chinese growth fears abated, it would appear the two greatest external factors that concerned the Fed are no longer going to hold it back. Well, as long as they don’t return of course. This was clearly evident on Wednesday as it removed the reference to global economic and financial risks from its monetary policy statement, which would suggest any hike in June will be entirely dependent on the performance of the domestic economy.

With this in mind, today’s GDP data is likely to be closely analysed for signs that the U.S. economy is growing at a pace that both justifies a rate hike at the next meeting and indicates that we’ll continue to see improvements in the labour market. Inflation has been hard to come by in recent years but should we continue to see positive developments in the economy and labor market, then this should pick up going forward, especially as the initial decline in energy markets continues to fall out of the calculation.

Once again we’re expecting disappointing first quarter growth though, just as we had in 2014 and 2015. On both of these occasions, investors feared the worst only for the economy to pick up for the rest of the year, and there’s no reason to believe this year will be any different. What we’ll be looking for from today’s data is a sign that we’re not going to a repeat of the last two years and what the U.S. is actually experiencing this year is slowing growth in a challenging global environment. If the latter is true, the Fed may again taper back its rate hike expectations to fall more in line with the market.

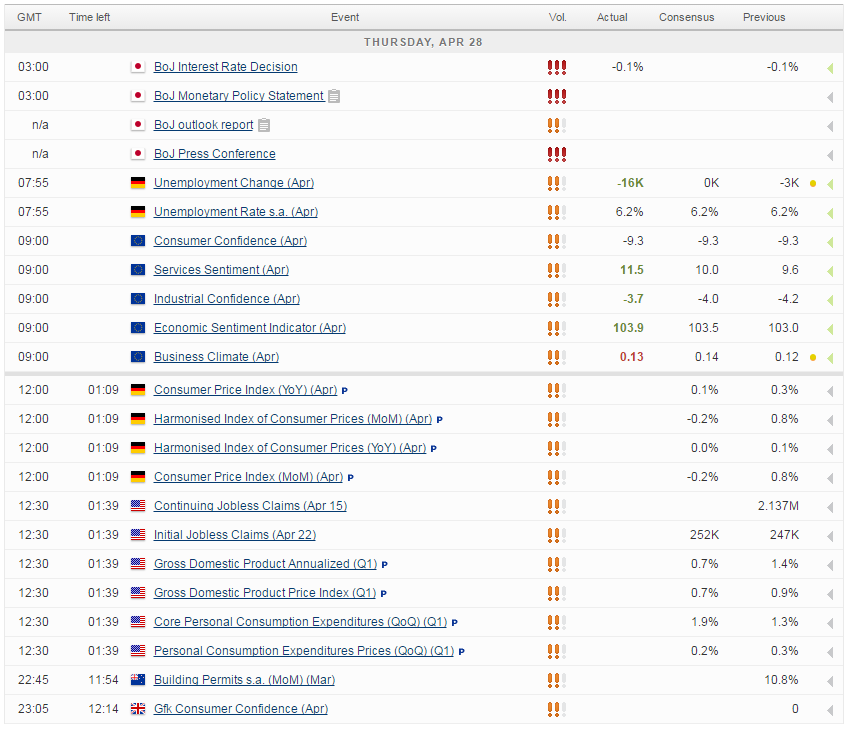

U.S. jobless claims will also be released on Thursday and are seen rising slightly to 252,000, which is still extremely low. We’ll also get more first quarter earnings announcements today, with 68 companies within the S&P 500 due to report.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.