The European session looks set for a relatively mixed start on Tuesday, with small oil losses today likely to keep the pressure on as we look ahead to some data from Germany, the eurozone and the U.S. as well as speeches from a number of central bank Governors.

Oil prices have been very volatile over the last 24 hours or so, having initially fallen more than 5% on the back of failed talks on an output freeze in Doha over the weekend, only to reverse these entirely shortly after. The rebound has been largely attributed to reports of a workers strike in Kuwait that could dramatically reduce its output from 3 million barrels per day before it started, but I think there are also other factors at play here.

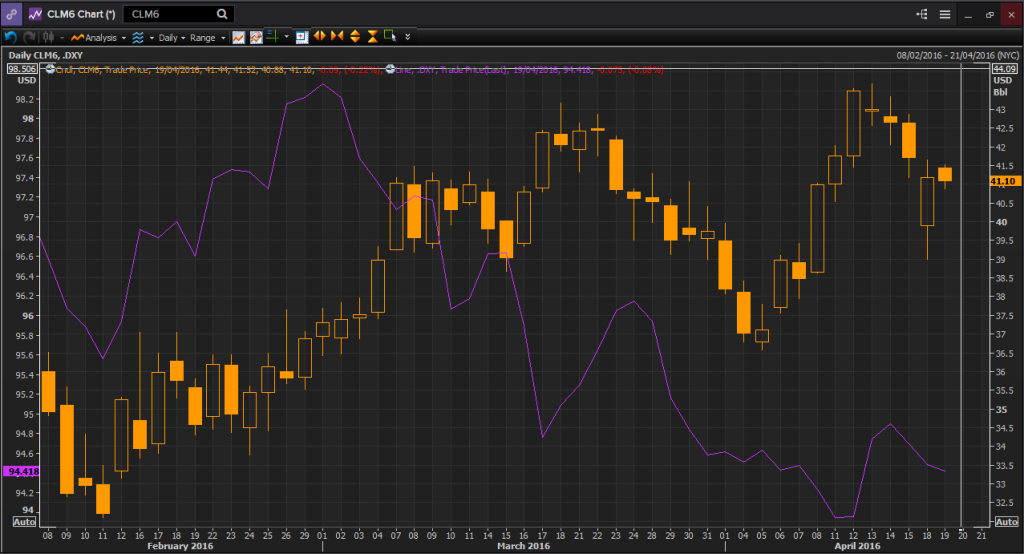

For one, the initial response to any news tends to be overdone and markets often stabilises shortly after. Secondly, it’s also likely that the weakness dollar in recent days will be offering some support to prices, with the correlation between the two having been quite strong since early March.

Source – Thomson Reuters Eikon Terminal

Finally, from a technical standpoint, the gap has been closed in WTI but we’re yet to see it trade above Friday’s close which I need to see before I can consider the bullish case for this in the short term.

Whatever the outcome, oil is likely to remain very active and interesting this week and so far, is slightly lower again today.

The yen started the week on the front foot once again but has since come off these highs, to ease the pressure on Japanese exporters and lift the Nikkei on Tuesday. We may finally be seeing signs of the yen finding a ceiling in the short term, having appreciated rapidly this year, particularly since the end of January.

This morning we’ll get the latest ZEW economic sentiment readings for Germany and the eurozone. Both are expected to see a small rebound off last month’s levels but remain very low as slowing growth in the global economy and demand in the key emerging market partners continues to hamper trade. This will be followed by housing data from the U.S. this afternoon, with building permits and housing starts figures being released for March. We’ll also hear from Bank of England Governor Mark Carney, Reserve Bank of Australia Governor Glenn Stevens and Bank of Canada Governor Stephen Poloz, all of whom are scheduled to speak this afternoon.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.