U.S. equity markets are expected to open slightly lower on the final trading day of the week, as investors eye a number of key economic reports and important meetings of the G20 and major oil producers.

Oil is trading a little lower so far today having entered into consolidation mode since Wednesday, as traders adopt a cautious approach ahead of Sunday’s meeting of oil producers in Doha. The consolidation in Brent and WTI comes following a strong rally over the previous week which took both close to important price levels that could determine how oil trades in the weeks ahead.

The outcome of Sunday’s meeting is likely to be the catalyst for the next move with the prospect of a deal being broadly being behind prices rising to where they have. The question is whether they can live up to expectations and come to an agreement that at the very least commits them to an output freeze. Any suggestion that output will be cut would likely be the trigger for more significant gains in oil but that strikes me as being very unlikely at this stage. I think it’s far more likely that they won’t live up to expectations and the path of least resistance in oil is therefore to the downside.

APAC-CURRENCY CORNER – CHINA RETAIL SURPRISE

Another key focal point for investors today is the G20 meeting in Washington. The markets have been quite stable since the last meeting, which I don’t think is a coincidence. Central Banks appear to be making a concerted effort to avoid further instances like those in August and January when financial markets were gripped by fear and panic. The Fed has since reigned in its tightening ambitions, while the ECB targeted its stimulus at improving credit channels rather than weakening the euro and the Bank of Japan has so far resisted the temptation to intervene to stop the rapid appreciation of the yen. It’s also been very quiet on the yuan front, which was previously the trigger for so much market volatility.

I expect the G20 to agree to carry on along the same path for now, although the strength of the yen may be discussed. While the BoJ has resisted temptation until now, I do think further monetary easing will come soon and will probably get the approval of the rest of the G20. It will be interesting to see what comments follow the meeting and whether there’ll be any particular reference to certain currencies, such as the yen or the yuan.

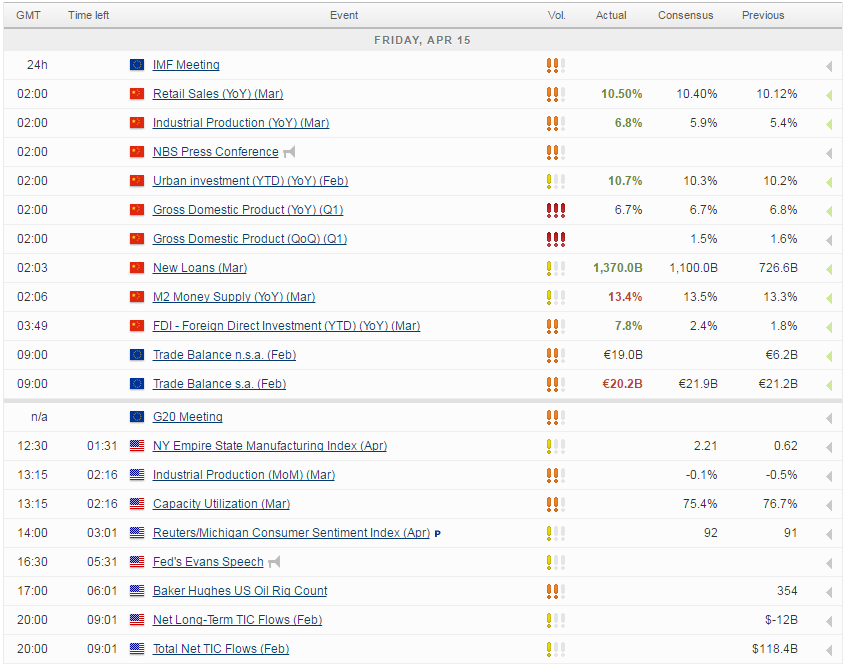

There are also a number of pieces of U.S. data to contend with today, with the preliminary reading of UoM consumer sentiment, empire state manufacturing index, industrial production and capacity utilisation figures all being released. On top of this there is also some earnings reports due which should attract plenty of attention.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.