European futures are pointing slightly lower ahead of the open on Tuesday, as investors eye the latest inflation data from the U.K. and negotiations between Greece and its lenders continue.

Inflation in the U.K. has been well below target for most of the last two years, with the sharp declines in oil prices being a particular drag on prices. Even the core number though, which strips out the direct impact of volatile energy, food, alcohol and tobacco moves, has been well short of the Bank of England’s 2% target and even this month is only expected to rise to 1.3%.

With that in mind, it’s no surprise that the BoE is in no rush to start raising interest rates, especially given the growing number of risks to the U.K. economy this year, most notably the E.U. referendum in June, slowing global growth and the ever-loosening monetary policies of other major central banks which until recently has meant the pound has remained very strong.

Greece and its creditors are yet to agree a deal that will enable the next tranche of Greece’s bailout to be released, although all of the noises coming from the negotiations do sound positive. Of course, this has been the case during numerous negotiations in the past which have gone well beyond the initial deadlines set and continued right up to the point where Greece is bordering on default.

Greek Finance Minister Euclid Tsakalotos remains optimistic that a deal can be agreed in time for the meeting of the eurozone finance ministers on 22 April, the only problem being that the same old issues remain. The most notable of these centres around pension cuts which the E.U. are insisting on and which the Greek government is extremely reluctant to do. For this reason alone, negotiations could continue for some time yet.

Brent crude has started the day slightly in the red after making further gains on Monday, only slightly falling short of the highs achieved in the middle of last month. The rally last week was initially triggered by the surprise draw-down in weekly crude oil stocks as reported by API and if we get a repeat of that this week, it could push Brent through last month’s highs, at which point $45 and $47.50 could become key levels of interest.

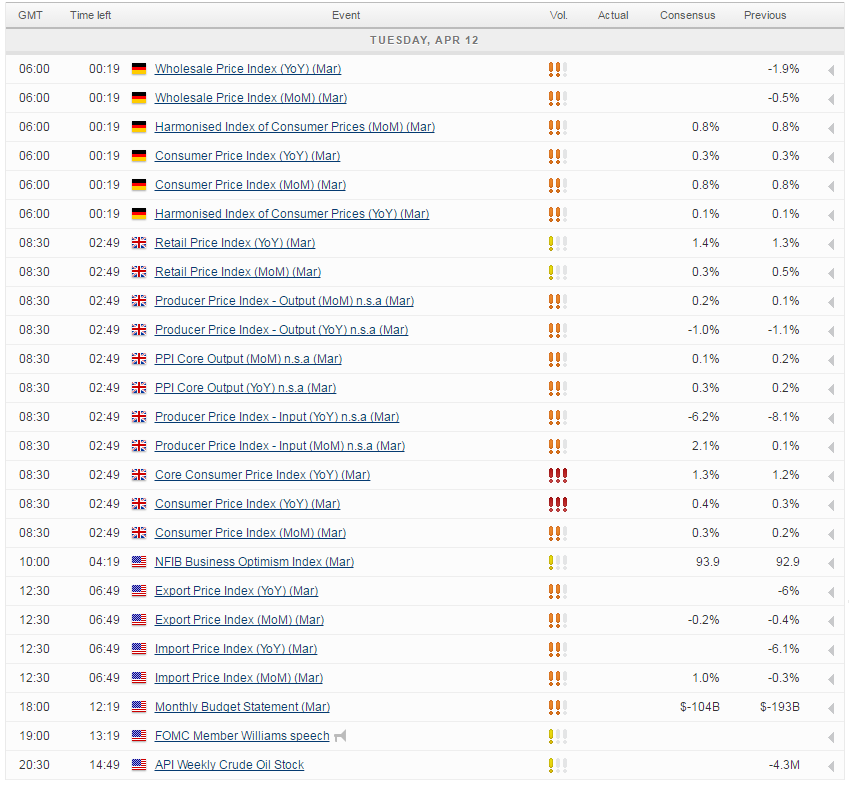

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.