The Federal Reserve will be back in focus again on Wednesday as we get the release of the minutes from last month’s FOMC meeting and get the up-to-date views of a few policy makers.

While the markets have been insistent for some time that the Fed was too optimistic in its assessment that the economy would warrant four rate hikes this year, it took the central bank a while to come to the same conclusion. The decision at the last meeting to revise its forecasts for hikes this year from four to two was welcomed by the markets but now seems we’re back in a position where the markets aren’t even convinced we’ll see a single rate hike this year.

Such is the conflicting comments coming from the different Fed officials on the economy and the outlook for interest rates that it’s difficult to see where a consensus on a rate hike is going to come from. Especially when Fed Chair Janet Yellen is sounding among the more dovish, playing down the up-tick in inflation and playing up the global risks.

It will be interesting to see from the minutes whether any consensus on a hike was even close or if they’re as far away from a hike as they appear from their public comments. While these minutes are dated to an extent, with the meeting now having taken place around three weeks ago, they should still offer valuable insight on the path of rates this year and what could speed this up or apply the breaks even harder.

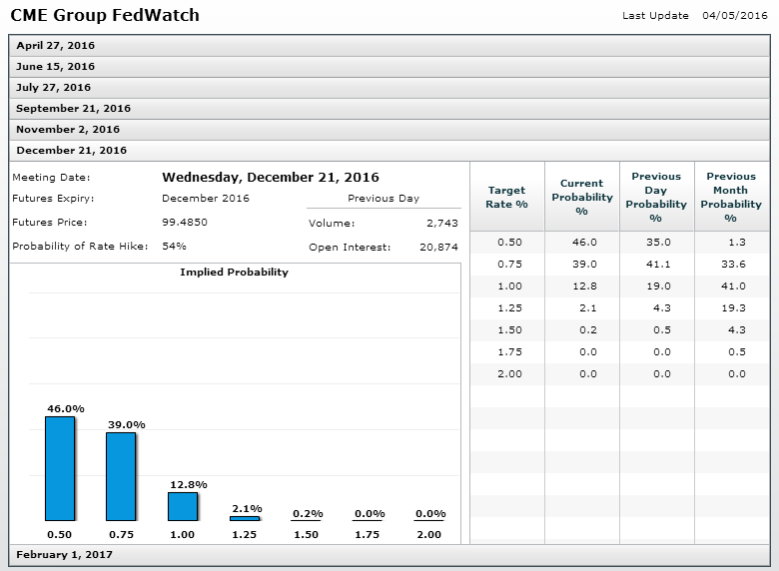

The problem we now have is that with a rate hike not being priced in until December – and even then only 54% chance of a hike based on Fed Funds futures – the markets have left themselves exposed to potential shocks should the minutes indicate a need for a hike in the upcoming meetings, in order to avoid raising too fast further down the road.

Source – CME Group FedWatch Tool

What may provide more timely insight is comments from the Fed officials themselves and we are due to hear from three throughout the day. James Bullard and Loretta Mester are both voting members of the FOMC this year and tend to fall in the hawkish camp. Bullard recently claimed that the markets are out of sync with the Fed and that the April meeting, like all going forward, are “live”. It will be interesting to see if he still holds this view. Mester recently claimed that she believes the Fed shouldn’t wait too long before pulling the trigger again and indicated that only a lack of data for the first quarter stopped her dissenting. The minutes, if not her speech, may provide more insight into where exactly we need to see such improvements. We’ll also hear from Robert Kaplan today who is not a voting member this year.

Also, we’ll get the EIA crude inventories number today, which comes after API data indicated that stocks surprisingly fell by 4.3 million last week. The release prompted some strength in oil markets today, the sustainability of which I imagine will rely on EIA confirming the draw-down last week.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.