European investors return on Tuesday following the long bank holiday weekend and while the trading week may be a little shorter it’s likely to be quite eventful, with particular interest being on the Federal Reserve ahead of its April meeting.

While the markets are currently far from convinced that the Fed will raise interest rates again at its April meeting – only 12% chance of a hike priced in based on Fed Funds futures – this could change dramatically this week.

Source – CME Group FedWatch Tool

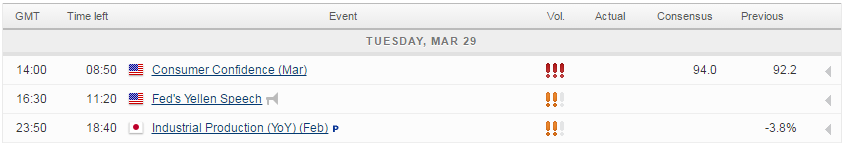

Fed Chair Janet Yellen is due to speak today on the Economic Outlook and Monetary Policy at the Economic Club of New York luncheon and her comments are likely to be followed very closely, especially given the more hawkish tone we’ve had from a number of other policy makers over the last week.

There’s also a number of key economic releases due this week which could force investors to reconsider their apparent insistence that a hike is not imminent. Monday’s core personal consumption expenditure price index – the Fed’s preferred inflation measure – did little to change people’s belief’s, despite remaining at 1.7%, only slightly below the Fed’s 2% target. There are a number of data releases this week which investors are likely to monitor still, none more so than Friday’s jobs report which rarely fails to get a reaction out of investors.

While European equity markets are currently seen opening around half a percentage point higher, we could well see traders approach this week with some caution given what lies ahead and the impact it could have on next month’s Fed meeting. The Asian session overnight was relatively mixed which didn’t offer much direction for the coming session and Europe is looking relatively quiet from a data perspective today.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.